- Advanced Accounting

- HR Payroll

- HR Certification by RGCMS

- IATA Certification

- Advanced Accounting

- HR Payroll

- HR Certification by RGCMS

- IATA Certification

- Advanced Accounting

- HR Payroll

- HR Certification by RGCMS

- IATA Certification

- Advanced Accounting

- HR Payroll

- HR Certification by RGCMS

- IATA Certification

- Advanced Accounting

- HR Payroll

- HR Certification by RGCMS

- IATA Certification

- Advanced Accounting

- HR Payroll

- HR Certification by RGCMS

- IATA Certification

" Best Accounting Software in India – Trusted Tools for Accountants"

Image of post regarding course

Table of Contents

- Introduction

- Why Accountants Need to Know About Accounting Software

- Key Features to Look for in Accounting Software

- Top 7 Best Accounting Software in India for Accountants to Learn in 2025

- The Best Certification Programs in India to Learn Accounting Software

- Skills on Demand in Addition to Accounting Software

- Most Commonly Asked Questions

Introduction Every accountant who wants to advance their career, simplify their finances, and remain in compliance with the most recent GST regulations needs to have access to the best accounting software available in India. Learning the right software can lead to high-paying jobs for students, business owners, and finance professionals alike.

olffer image

Why Accountants Need to Know About Accounting Software

With the increasing digitization of finance and taxation in India, accountants must be tech-savvy. Professionals with the ability to effectively manage ledgers, file GST returns, and analyze financial data are now in high demand from businesses. From startups to MNCs, every business relies on accounting software to keep their books clean. The right tool can significantly reduce human error and save hours of manual labor.

olffer image

Key Features to Look for in the Best Accounting Software in India

GST Completion The Goods and Services Tax is the central component of India’s tax system. For easy filing and billing, make sure the software you learn has built-in GST compliance.

User-Friendly InterfaceEven for novices, using an intuitive interface makes learning simple.

Using the Cloud Modern software solutions offer cloud access, which is ideal for remote teams and data security.

Electronic Reporting Time is saved and the likelihood of making mistakes in financial reports is reduced by automation and the demand for tally is increasing.

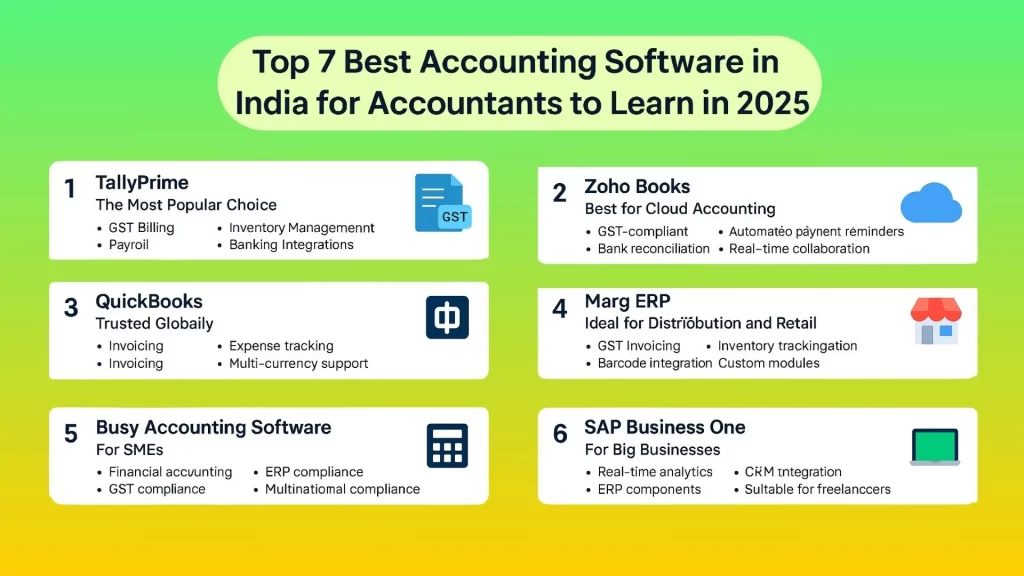

Top 7 Best Accounting Software in India for Accountants to Learn in 2025

1. TallyPrime – The Most Popular Choice For a number of years, Tally has dominated the Indian market. TallyPrime is the updated version and offers a user-friendly interface with comprehensive features.

Key Features:

GST Billing

Inventory Management

Payroll

Banking Integrations

2. Zoho Books – Best for Cloud Accounting Zoho Books is ideal for freelancers, new businesses, and established ones. It is cloud-based and reasonably priced.

Key Features:

GST-compliant

Automated payment reminders

Bank reconciliation

Real-time collaboration

3. QuickBooks – Trusted Globally QuickBooks by Intuit is well-known all over the world and has a lot of features for Indian users.

Key Features:

Invoicing

Expense tracking

Multi-currency support

Mobile accessibility

4. Marg ERP – Ideal for Distribution and Retail Marg ERP is widely used by retailers and pharmaceutical companies in India.

Key Features:

GST Invoicing

Barcode Integration

Inventory tracking

Custom modules

5. Busy Accounting Software – For SMEs Another piece of software developed locally that caters to small and medium-sized businesses is called Busy.

Key Features:

Financial accounting

GST compliance

MIS reports

Multi-location inventory

6. SAP Business One – For Big Businesses Large businesses that require in-depth analytics and reports can benefit from SAP Business One.

Key Features:

Real-time analytics

ERP components

CRM Integration

Multinational compliance

7. Wave Accounting – Free and Beginner-Friendly If you’re starting your accounting journey, Wave is a great entry point.

Key Features:

Free forever

Easy interface

Receipts & invoices

Suitable for freelancers

need more information related to accounting check this here

Should You Choose an Accounting Software?

Choosing the right accounting software depends on your career goals, business type, and the complexity of accounting tasks you handle. Whether you’re a student aiming for certification, a freelancer managing invoices, or a professional accountant in an MNC, there’s a tool tailored for your needs.

Here’s a quick comparison to help you choose:

| Software | Best For | Key Feature Highlight |

|---|---|---|

| TallyPrime | Beginners & GST Professionals | Offline GST Billing & Inventory |

| Zoho Books | Startups & Cloud Accounting | Cloud Access & Real-Time Sharing |

| QuickBooks | Freelancers & Small Businesses | Global Currency & Mobile Support |

| Marg ERP | Retailers & Pharma Distributors | Barcode Integration |

| Busy Software | SMEs | Multi-location Inventory |

| SAP Business One | Corporates & Enterprises | ERP + CRM + Analytics |

| Wave | Freelancers & Beginners | 100% Free & Easy to Use |

The Best Certification Programs in India to Learn Accounting Software

Course on GST Tally This course, which is offered by a lot of schools all over India, covers tax compliance, inventory management, and billing.

Partner Certification for Zoho Books Zoho offers a certified program for accountants and partners.

QuickBooks ProAdvisor Certification This internationally recognized certification is ideal for independent accountants

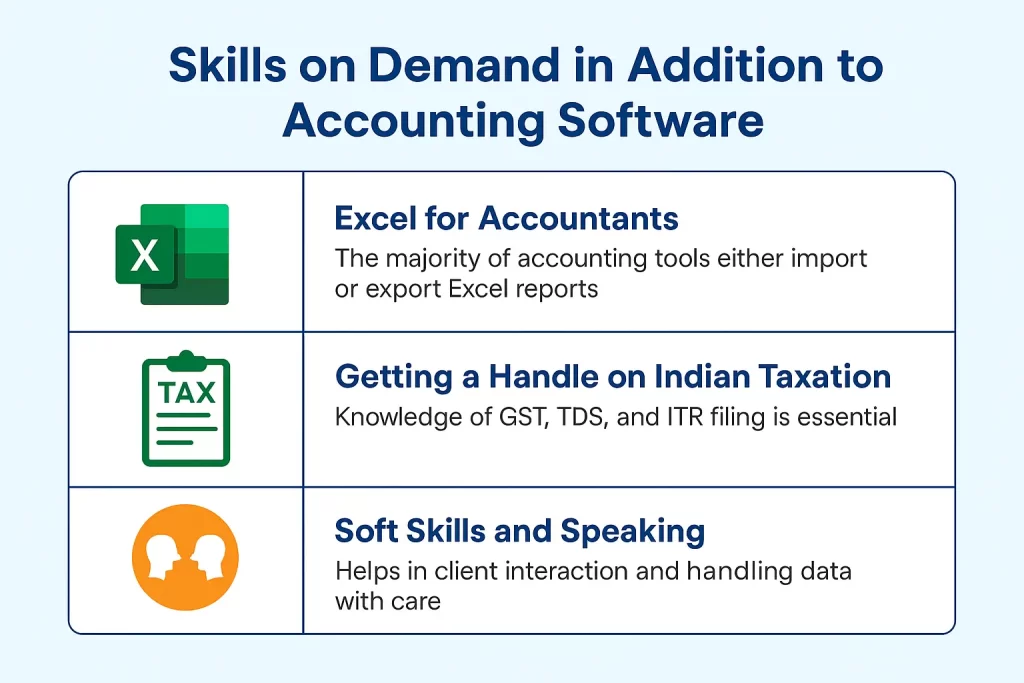

Skills on Demand in Addition to Accounting Software

If you’re serious about mastering the best accounting software in India, combine it with these skills:

Excel for Accountants The majority of accounting tools either import or export Excel reports.

Getting a Handle on Indian Taxation Knowledge of GST, TDS, and ITR filing is essential.

Soft Skills and Speaking Helps in client interaction and handling data with care.