Mastering Payroll Accounting: What is Payroll Accounting and Why It Matters in Business

Table of Contents

- Introduction to Payroll Accounting

- Key Components of Payroll Accounting

- Payroll Accounting Process Explained

- Payroll Accounting vs. General Accounting

- Common Payroll Accounting Software

- Challenges in Payroll Accounting

- Career Opportunities in Payroll Accounting

- Learn Payroll Accounting Professionally

- FAQs about Payroll Accounting

Introduction

In the evolving world of business management, payroll remains a critical aspect that directly affects employee satisfaction and legal compliance. But many still wonder — what is payroll accounting? It goes beyond simply paying salaries. A structured financial system known as payroll accounting keeps businesses in compliance with labor and tax laws while also ensuring that employees are paid accurately and promptly. Understanding what is payroll accounting is essential for HR professionals, accountants, business owners, and aspiring job seekers aiming to enter the finance or human resources industry.

What exactly is payroll accounting?

The term “payroll accounting” is used to describe the process of keeping track of, managing, and recording employee compensation, such as wages, bonuses, tax deductions, and so on. It ensures that tax obligations are met without error and that employees are paid appropriately. Gross wages are calculated, deductions are subtracted, tax reports are filed, and each transaction is recorded in the company’s financial records as part of payroll accounting. Knowing what is payroll accounting allows businesses to maintain transparency and legal compliance.

Why is Payroll Accounting Important for Businesses?

Understanding what is payroll accounting helps in realizing its business significance. It plays a major role in:

Ensuring accurate payment to employees

Preventing legal penalties through tax compliance

Fostering employee confidence

Keeping accurate financial records

Fines, employee dissatisfaction, and legal issues are all possible outcomes for businesses that neglect or mishandle payroll accounting that’s why understanding what is payroll accounting is important.

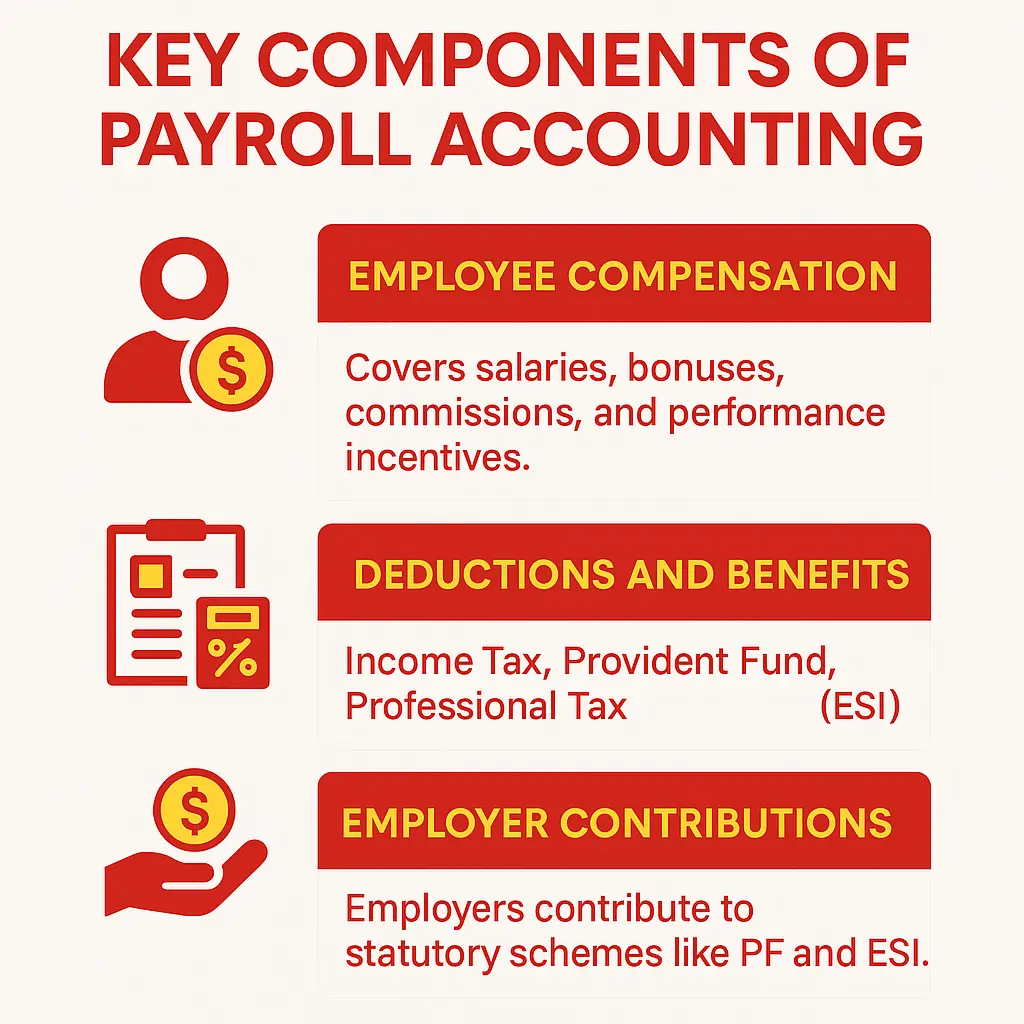

Key Components of Payroll Accounting

Employee Compensation

Employee compensation is the foundation of payroll accounting. It includes commissions, performance bonuses, overtime pay, basic salary, and other benefits. Accurately recording these elements ensures compliance with labor laws and fairness to employees.

Deductions and Benefits

Payroll accounting manages various statutory and voluntary deductions such as:

Income Tax

The Provident Fund

Professional Tax

Employee State Insurance (ESI)

It also includes benefits like health insurance, retirement plans, and paid leaves.

Employer Contributions

Employers must contribute to statutory schemes like PF and ESI. Understanding what is payroll accounting helps ensure these are properly calculated and recorded.

Payroll Accounting Process Explained

Recording Payroll Transactions

All payroll-related transactions are recorded in journal entries. The deductions, net pay, and gross wages are all meticulously accounted for. Audits are made easier and financial transparency is promoted as a result.

Tax Calculations and Deductions

Payroll systems calculate applicable taxes and automatically deduct them from employee salaries. These deductions are then submitted to the government, avoiding penalties and non-compliance.

Payslip Generation and Reporting

Employees receive payslips that detail their earnings, deductions, and take-home salary. Transparency and future reference depend on these reports.

Payroll Accounting vs. General Accounting

Differences in Process and Purpose

Payroll accounting specifically deals with employee compensation, while general accounting records all company financials. It requires additional attention due to tax regulations and employee entitlements.

Why Payroll Requires Specialized Knowledge

Knowing “what is payroll accounting” means knowing that it is a very specific field. To effectively manage it, accountants need to be familiar with payroll software systems, tax codes, and labor laws.

Common Payroll Accounting Software

Top Software Used in India

Some popular software tools used in India for payroll accounting include:

GreytHR

Keka

Zoho Payroll

ADP India

Saral PayPack

These tools make make the understanding of “what is payroll accounting ” easier and streamline the payroll process, reduce errors, and ensure timely disbursements.

Features to Look for in Payroll Tools

When choosing a payroll tool, make sure it offers:

Tax compliance automation

Creation of pay stubs

Multi-location support

Employee self-service portal

Integration with attendance systems

These features make it easier for businesses to manage employee compensation efficiently.

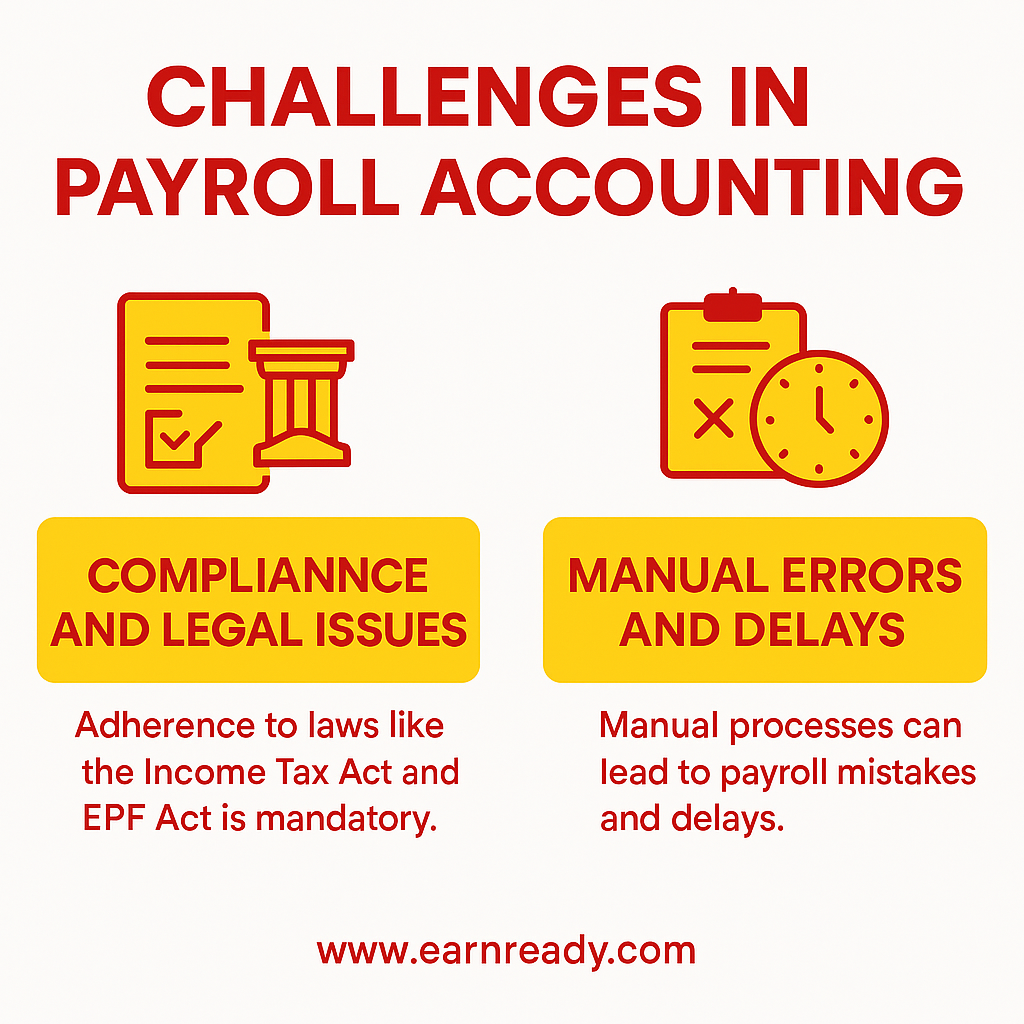

Challenges in Payroll Accounting

Compliance and Legal Issues

Payroll accounting must comply with multiple laws, including the Payment of Wages Act, Income Tax Act, and EPF Act. Failing to comply may result in audits, fines, or legal proceedings.

Manual Errors and Delays

Manual payroll processing can lead to human errors, delayed payments, and miscalculations. Using payroll software helps solve these problems and makes operations run more smoothly.

Career Opportunities in Payroll Accounting

In-Demand Job Roles

Understanding what is payroll accounting opens up many lucrative career paths:

Payroll Accountant

HR Payroll Executive

Specialist in Payroll

Manager of Compensation and Benefits

Finance Officer with Payroll Specialization

These roles are essential in every organization and often come with long-term growth potential.

Skills Required for Payroll Accounting Professionals

To thrive in payroll accounting, professionals should have:

Knowledge of tax laws and labor regulations

Knowledge of payroll software

Analytical thinking

Attention to detail

Communication skills

Certified professionals in payroll accounting often receive better salary packages and faster career progression.

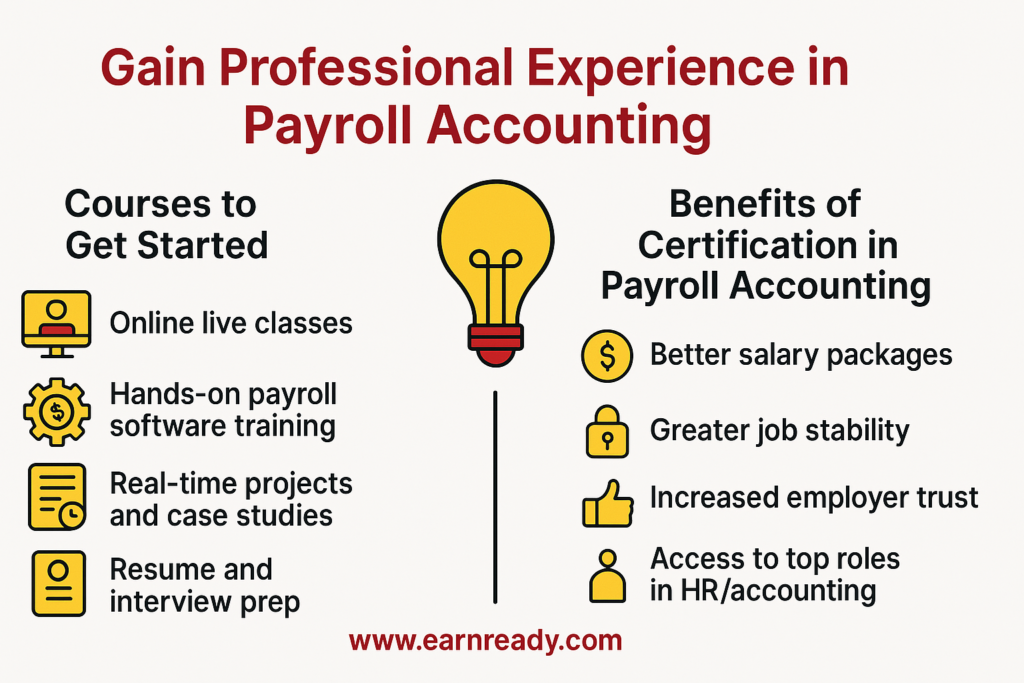

Gain professional experience in payroll accounting

Courses to Get Started

If you’re serious about building a career in HR or finance, don’t just ask what is payroll accounting — learn how to master it.

EarnReady offers one of India’s best courses in HR and Payroll Accounting, including:

Online live classes

Hands-on payroll software training (Zoho Payroll, Excel, etc.)

Real-time projects and case studies

Resume building and interview preparation

100% job assistance

Benefits of Certification in Payroll Accounting

Certified payroll professionals gain:

Better salary packages

Greater job stability

Increased trustworthiness among employers

Access to top HR and accounting roles

If you’re a student, job-seeker, or working professional, this is your gateway to a high-paying, stable, and respected career.