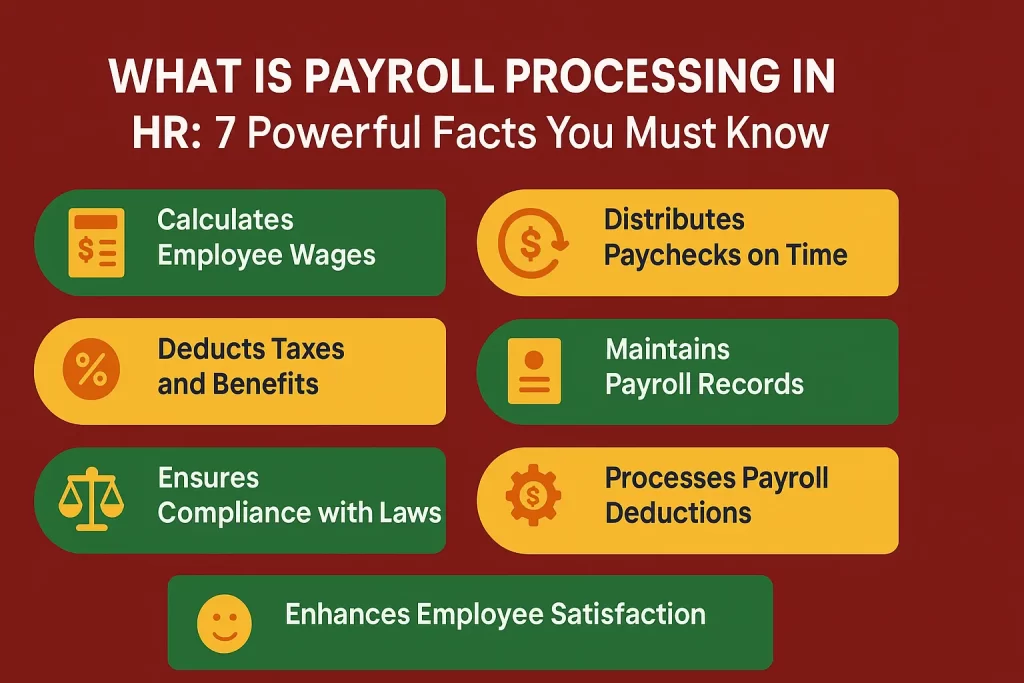

What is Payroll Processing in HR: 7 Powerful Facts You Must Know

Table of Contents

What is Payroll Processing in HR?

Understanding what is payroll processing in hr is crucial for anyone pursuing a career in Human Resources. Payroll processing involves calculating employee salaries, tax deductions, benefits, bonuses, and ensuring employees are paid correctly and on time.

Why Understanding What is Payroll Processing in HR is Crucial

Companies depend on accurate payroll to maintain employee trust. Knowing what is payroll processing in hr ensures you follow legal and financial obligations properly, avoiding penalties and boosting organizational efficiency.

Components Included in What is Payroll Processing in HR

When discussing what is payroll processing in hr, it’s important to know the components:

Salary structure

Attendance and leave records

Tax deductions (TDS, PF, ESI)

Bonus and incentives

Final settlements

Each of these components is integral to understanding what is payroll processing in hr.

The Step-by-Step Guide on What is Payroll Processing in HR

A major part of mastering what is payroll processing in hr is following a step-by-step approach:

Gathering employee information

Calculating gross salary

Deducting taxes and contributions

Disbursing salaries

Generating payroll reports

By understanding these steps, you get a full grasp of what is payroll processing in hr.

Important Documents Needed for What is Payrolls Processing in HR

When learning payroll processing in hr, know that documentation is critical. These include:

Offer letters

Employment contracts

Timesheets

Salary revision letters

Resignation letters

Documents ensure transparency and accuracy when implementing what is payroll processing in hr.

Common Challenges Faced While Managing What is Payrolls Processing in HR

Understanding payroll processing in hr also means recognizing the challenges:

Frequent changes in tax laws

Manual calculation errors

Incomplete employee data

Delayed salary payments

These challenges emphasize the need to master what is payroll processing in hr efficiently.

Benefits of Learning What is Payrolls Processing in HR

Those who deeply understand what is payroll processing enjoy benefits like:

Enhanced career prospects

Better organizational reputation

Higher employee satisfaction

Reduced legal risks

Mastering the payroll processing in hr can dramatically uplift an HR career.

The Role of Software in What is Payrolls Processing in HR

Technology plays a big role in simplifying payroll processing in hr:

Automating salary calculations

Generating statutory reports

Managing employee data digitally

Reducing manual errors

Software solutions make mastering what is payroll processing in hr easier and more reliable.

The Legal Importance of What is Payrolls Processing in HR

Every HR professional must understand the legal obligations tied to payroll processing in hr:

Compliance with labor laws

Timely tax filing

Generating government-mandated reports

Ensuring employee rights are protected

Failing to comply with the rules related to what is payroll processing in hr can result in heavy penalties.

The Future Trends in What is Payrolls Processing in HR

Keeping an eye on future trends is vital when studying payroll processing in hr:

Cloud-based payroll systems

AI-driven payroll automation

Real-time salary processing

Advanced security for data protection

Understanding upcoming trends strengthens your knowledge of what is payroll processing in hr.

What is Payrolls Processing in HR for Small Businesses?

Small businesses must also understand what is payroll processing in hr:

Setting up a simple salary structure

Ensuring legal compliance

Using affordable payroll tools

Managing multi-role employees

For startups, knowing what is payroll processing in hr can save time and avoid costly mistakes.

Best Practices for Managing What is Payrolls Processing in HR

Experts recommend these best practices for effective payroll processing in hr:

Timely record updates

Regular audits

Training payroll staff

Using modern software

Following these practices ensures that you manage payroll processing in hr smoothly and efficiently.

Training Courses That Teach What is Payrolls Processing in HR

There are many courses available that teach what is payroll in hr:

Online certifications

Professional workshops

HR diploma programs

Corporate training sessions

Investing in education about payroll processing in hr will boost your HR career prospects significantly.

Industries Where Understanding What is Payrolls Processing in HR is Essential

Mastery of payroll processing in hr is critical across industries like:

IT companies

Manufacturing firms

Retail businesses

Healthcare organizations

Every sector needs experts who know payroll processing in hr thoroughly.

Real-Life Examples of Successful What is Payrolls Processing in HR

Companies that excel at payroll processing in hr see:

Higher employee retention

Minimal compliance issues

Increased productivity

Stronger financial management

Learning from these companies can enhance your own approach to payroll processing in hr.

Key Mistakes to Avoid When Managing What is Payrolls Processing in HR

When you understand payroll processing in hr, you can avoid mistakes like:

Incorrect tax calculations

Missing payment deadlines

Mishandling employee records

Failing to communicate changes

Avoiding these errors ensures flawless payroll processing in hr.

The Impact of COVID-19 on What is Payrolls Processing in HR

COVID-19 changed payroll processing in hr by:

Introducing remote payroll management

Adjusting salary structures

Managing furloughs and layoffs

Enhancing digital payroll processes

Professionals adapted quickly to maintain effective payroll processing in hr.

Why Employees Appreciate Smooth What is Payrolls Processing in HR

Employees value organizations that excel at payroll processing in hr because:

They receive accurate and timely salaries

They trust the management more

Their financial planning becomes easier

Prioritizing payroll processing in hr leads to happier employees.

Career Opportunities for Professionals Skilled in What is Payrolls Processing in HR

If you master payroll processing in hr, you can explore roles like:

Payroll Specialist

HR Manager

Compliance Officer

Finance Administrator

Mastery of payroll processing in hr opens up lucrative career paths.

How to Prepare for Interviews About What is Payrolls Processing in HR

When interviewing, expect questions about what is payroll in hr such as:

How would you calculate net pay?

How do you ensure payroll compliance?

Describe a time you fixed a payroll error.

Studying payroll processing in hr thoroughly can help you ace these interviews.