Importance of HR Payroll in Business: A Must-Know for Every HR Professional

Introduction

Payroll is more than just processing salaries—it’s the backbone of employee satisfaction and legal compliance. A well-managed payroll system ensures that employees are paid accurately and on time, boosting morale and trust within the company. But beyond payments, payroll also involves managing taxes, statutory deductions, benefits, and reporting—all of which are critical for legal and financial accuracy.

For businesses, especially startups and growing companies, payroll errors can lead to penalties, employee dissatisfaction, and even reputational damage. That’s why having skilled payroll professionals is vital. They not only keep the company compliant with ever-changing labor laws but also optimize payroll processes for better efficiency.

Enrolling in an HR payroll course is a game-changer for anyone looking to enter or advance in the HR field. These courses offer hands-on training in payroll software, tax regulations, salary structuring, and compliance. You’ll gain practical knowledge that employers highly value—making you a reliable and skilled asset to any organization.

Whether you’re a recent graduate, a working professional, or someone looking to switch careers, ancourse equips you with the expertise to manage one of the most important functions in any business. It’s not just a course—it’s your pathway to becoming a trusted payroll expert.

Legal Compliance

A properly managed payroll system ensures your business stays compliant with all applicable laws and regulations. It’s not just about issuing salaries—it’s about maintaining financial and legal discipline. From calculating Income Tax deductions (TDS) to managing contributions like Provident Fund (PF) and Employee State Insurance (ESI), every component must be accurately handled. Mistakes in payroll processing can lead to missed deadlines, government penalties, surprise audits, or even legal action, all of which can damage the company’s reputation and bottom line.

This is where an HR payroll course becomes invaluable. These courses are designed to teach you how to:

Calculate and file taxes correctly, ensuring timely payments and accurate TDS deductions

Maintain PF, ESI, and other statutory contributions, which are essential for employee benefits and compliance

Stay updated with changes in labor laws, so you’re never caught off-guard by new rules or amendments

Handle audits confidently, with complete and well-organized payroll documentation

By mastering these areas, you build legal resilience into the company. A well-trained payroll professional ensures smooth, error-free operations and shields the organization from unnecessary financial and legal risk. Investing in this expertise through an HR payroll course is not just smart—it’s essential.

Employee Trust

Employees expect their salary to be processed accurately and on time, every single month. It’s not just a financial transaction—it’s a reflection of how much the company values and respects its workforce. When salaries are delayed or deductions appear unclear, it leads to frustration, lowered morale, and a breakdown in trust between employees and management.

A well-structured payroll system ensures:

Timely salary disbursement, which boosts employee satisfaction and motivation

A clear breakdown of earnings and deductions, so employees understand exactly how their salary is calculated

Regular issuance of payslips, providing a transparent record of salary, taxes, and benefits

Transparency in bonuses, reimbursements, and incentives, reinforcing fairness and accountability

When payroll is managed efficiently, it strengthens employee confidence and enhances workplace culture. A transparent and error-free payroll process reassures employees that they’re being treated fairly and professionally.

An HR payroll course equips professionals with the skills to manage these responsibilities with precision. From leave tracking to overtime and incentive calculations, the course trains you to handle real-time payroll scenarios. This knowledge not only ensures accuracy but also builds trust between employees and the organization—making payroll management a key driver of employee morale and retention.

Financial Planning

Payroll data is crucial for accurate financial forecasting and effective cost control. In any organization, understanding the full scope of HR is key to managing manpower expenses wisely. HR insights allow businesses to evaluate the true cost of their workforce, from monthly salaries to additional statutory expenses such as Provident Fund (PF), Gratuity, and Employee State Insurance.

One of the major benefits of mastering HR data is its role in budgeting for new hires. When expanding a team, companies need clear visibility into current and projected payroll expenses. Similarly, HR analysis supports calculating annual raises, bonuses, and other compensation adjustments in a financially sustainable way.

Without proper practices, businesses often face unplanned costs or poorly allocated funds. That’s why comprehensive payroll training programs include modules on budgeting, forecasting, and payroll reporting. These tools not only ensure compliance but also enhance financial efficiency.

payroll analytics empower HR professionals and finance teams to make smarter, data-driven decisions. With a firm grasp of HR metrics, companies can align their human capital strategy with long-term business goals. In today’s competitive environment, understandingis more than an administrative task—it’s a strategic advantage.

Reputation Management

In today’s connected and fast-paced business world, even a single payroll error can significantly damage a company’s reputation—both internally with employees and externally with the public. A delayed salary, tax miscalculation, or missed compliance filing can trigger a cascade of negative outcomes. These may include poor reviews on job portals, a rise in employee resignations, government-imposed fines or audits, and even a loss of investor trust.

That’s why HR payroll accuracy is not just a back-office concern—it’s a frontline issue that impacts brand reputation and employee satisfaction. Organizations that prioritize management reduce the risk of such damaging errors. Skilled professionals trained in HR payroll are essential to ensuring timely salary processing, accurate tax deductions, and full statutory compliance.

Many companies now recognize the importance of investing in talent. Enrolling HR professionals in a certified HR payroll course provides them with the tools and knowledge to manage payroll operations with precision. From understanding tax regulations to mastering payroll software, these courses are designed to build expertise in all aspects .

Ultimately, a strong system supports smooth internal processes and maintains a company’s credibility. In today’s competitive market, mastering HR payroll is a smart move toward long-term success.

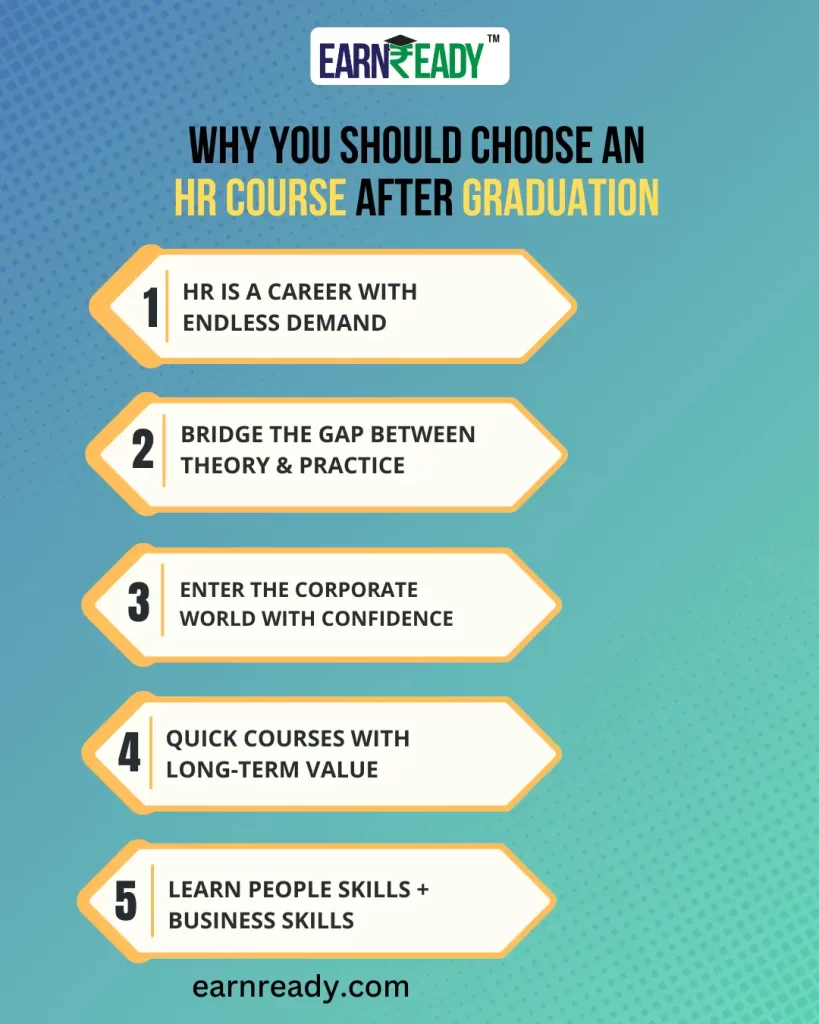

Why Learn Payroll?

Still wondering why you should invest in an payroll course? Here are some powerful reasons that make it a smart career move—whether you’re starting out in HR or looking to specialize.

HIGH DEMAND FOR PAYROLL SKILLS

Every business, big or small, relies on accurate payroll processing. With increasing focus on labor laws and compliance, skilled HR professionals are in constant demand. Companies actively seek individuals with HR expertise to manage complex pay structures, taxes, and employee benefits.

BETTER CAREER OPPORTUNITIES

An HR payroll course equips you with niche skills that are valued in both HR and finance departments. Whether you’re aiming for a corporate HR role or a payroll analyst position, mastering HR payroll can lead to better salaries and faster promotions. It’s a career path that blends administration, compliance, and financial acumen.

REAL-WORLD PAYROLL TOOLS

Top HR courses provide hands-on training with tools like Zoho Payroll, GreytHR, and Excel automation. Learning how to use these tools efficiently makes you job-ready across industries.

LEGAL CONFIDENCE

With the right HR payroll training, you’ll understand tax filing, deduction management, and legal compliance—skills that reduce company risk and boost your professional credibility.

An payroll course isn’t just education—it’s career empowerment.

Learn from the Best: EarnReady HR Payroll Course

Looking for a practical and job-oriented HR payroll course? EarnReady offers everything you need to build a strong foundation and launch a successful career in payroll management.

With real-time payroll processing training, you’ll gain hands-on experience in managing salary structures, deductions, and statutory compliance. The course includes case studies on tax filing, PF, and ESI—giving you the confidence to handle real-world scenarios that HR payroll professionals face every month.

EarnReady’s HR payroll course also comes with certification and 100% job assistance, making it ideal for freshers and working professionals looking to upskill. You’ll get exposure to live payroll software like Zoho Payroll and GreytHR, which are widely used across industries, ensuring you’re job-ready from day one.

In addition to technical payroll skills, the course supports your career journey with resume building and interview preparation sessions. This combination of practical training and career support gives you a competitive edge in the job market.

Whether you’re starting your career or upgrading your skills, EarnReady’s HR course is designed to help you master payroll and secure better opportunities. With expert guidance and real-world practice, you’ll become the go-to payroll expert every company needs.

Who Should Take an HR Payroll Course?

If you’re wondering who can benefit the most from an HR course, the answer is—almost anyone looking to grow in the HR or finance domain.

HR freshers who are just starting their careers can use an HR course to gain a valuable specialization. It helps them stand out in interviews by demonstrating practical knowledge of payroll processing, tax deductions, and compliance—skills that are in high demand.

Finance graduates often seek a niche skill to complement their degree. Learning HR gives them a unique edge, as it combines financial knowledge with practical HR functions, opening up roles in payroll analysis, HR operations, and compliance management.

MBA (HR) students preparing for placements will find that adding to their skill set makes them more competitive. Recruiters often prefer candidates who understand not just HR theory but also have hands-on experience with payroll systems and statutory requirements.

Working professionals aiming for promotions or a role switch into HR operations, compensation & benefits, or payroll management can benefit immensely from specialized HR payroll training.

In short, an course is a strategic investment for anyone who wants to grow, specialize, or transition in their career with confidence and competence.