Tally with GST Course: Powerful 2025 Guide to Learn Payroll Accounting & Land a Job Fast

Table of Contents

- Introduction

- What Is Tally with GST Course?

- Why Learn Payroll Accounting?

- Importance of GST in Accounting

- Features of Tally GST Software

- Career Benefits of Tally with GST Course

- Tally GST Course for Beginners

- How to Get a Job Without Experience

- Why EarnReady Is the Best Platform for Tally with GST Course

- Key Modules in EarnReady’s Tally GST Course

- Real-World Benefits of EarnReady Learners

- FAQ on Tally with GST Course

Introduction

Tally with GST course is one of the most job-oriented accounting certifications you can pursue today. It’s especially valuable if you’re just out of school or looking to enter the job market without any prior experience. In this powerful guide, we’ll explore why mastering payroll accounting through a professional Tally GST course is the smartest move in 2024—and why EarnReady is the best platform to help you get there.

What Is Tally with GST Course?

The Tally with GST course is a specialized training program designed to help students and professionals master business accounting, taxation, and payroll systems using the Tally software. It integrates the Goods and Services Tax (GST) module, making it highly relevant in today’s tax-driven financial landscape.

This course is ideal for anyone looking to start a career in accounting, especially those without a college degree or prior job experience.

Why Learn Payroll Accounting?

Payroll accounting is one of the most critical components of business finance. It involves tracking employee salaries, tax deductions, bonuses, and compliance with statutory requirements. With companies seeking skilled professionals in this domain, learning payroll accounting through a Tally GST course makes you job-ready fast.

By combining GST and payroll skills, you’re not just an accountant—you’re a valuable asset to any company.

Importance of GST in Accounting

GST has transformed the way businesses operate in India. Whether you’re dealing with sales, purchases, or payroll, GST plays a central role. The Tally with GST course ensures you understand:

GST registration

Return filing

Input Tax Credit

GST on salaries and wages

Real-time GST reporting in Tally

Understanding GST boosts your credibility and gives you an edge in job interviews.

Features of Tally GST Software

Tally ERP 9 and Tally Prime have built-in features to manage:

Payroll processing

Salary structure automation

Statutory payments (PF, ESI, TDS)

Monthly tax filings

GST return generation

The Tally with GST course teaches you how to use these features step-by-step. You don’t need any prior knowledge—just motivation and the right platform like EarnReady.

Career Benefits of Tally with GST Course

Here’s why this course is in high demand:

High employability for commerce students

Certifications increase trust from employers

Job-ready skills in under 3 months

Eligible for jobs in accounting, HR, and payroll departments

Ideal for people aiming to get a job without experience

Employers love hiring Tally-certified professionals because they need less training and can start contributing right away.

Tally GST Course for Beginners

If you’re new to accounting, don’t worry. The Tally with GST course is beginner-friendly. It starts with the basics:

What is accounting?

Types of business transactions

Introduction to Tally software

Creating ledgers and vouchers

GST configuration in Tally

By the end, you’ll feel confident enough to handle accounting tasks for small and medium businesses.

How to Get a Job Without Experience

A major benefit of the Tally with GST course is that you don’t need prior experience to start. Here’s how it helps:

You gain hands-on training with simulations

Learn industry-level payroll processes

Develop confidence in GST filing

Get a completion certificate to boost your resume

With EarnReady, your course certificate includes project work, making it easier to convince employers of your skills.

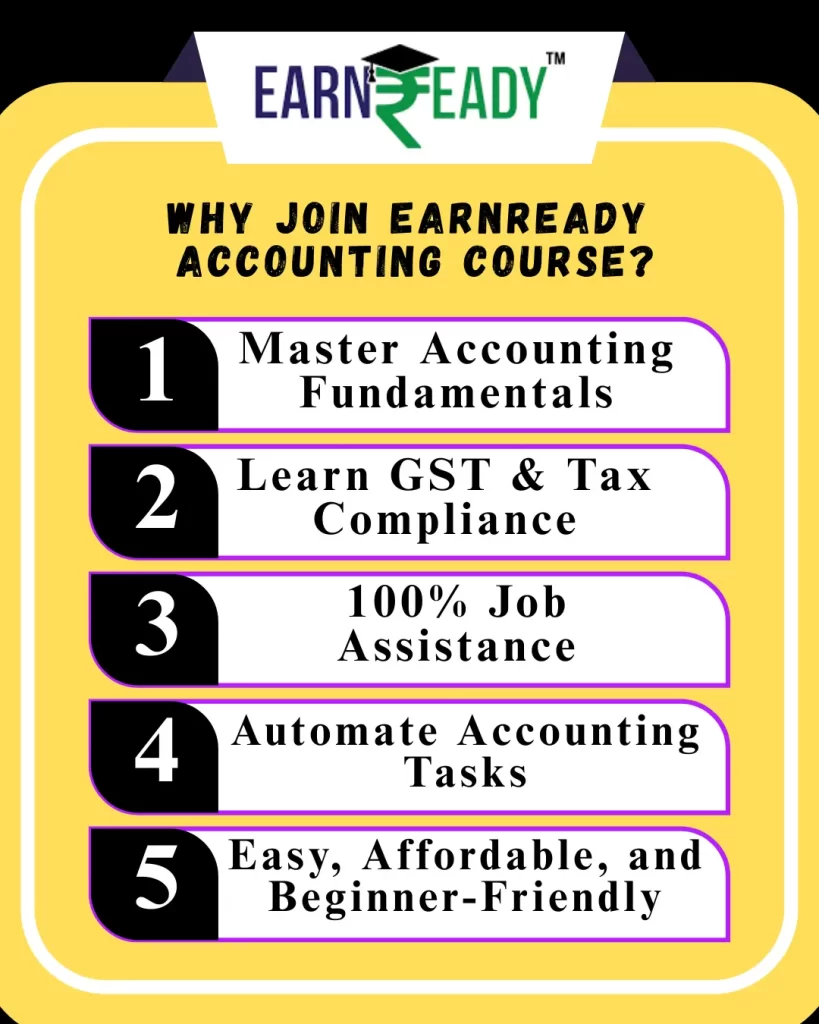

Why EarnReady Is the Best Platform for Tally with GST Course

EarnReady offers unmatched value to learners:

Flexible online access: Learn anytime, anywhere

Expert instructors: Trained professionals with industry knowledge

Job assistance: Help with resume building, mock interviews, and job search

Affordable pricing: Low cost compared to traditional institutes

Lifetime access: Review lessons even after completing the course

What makes EarnReady unique is its focus on practical training and job-readiness, not just theory.

Key Modules in EarnReady’s Tally GST Course

Here’s what you’ll learn:

Introduction to Accounting & Tally

Company Creation and Ledger Entries

GST Basics and Configuration

GST Invoices, Returns & Payments

Payroll in Tally: Salary Structures, ESI, PF, TDS

Generating Payroll Reports

Final Project and Job Interview Preparation

This well-rounded structure ensures you’re prepared for multiple career roles.

Real-World Benefits of EarnReady Learners

Here’s how EarnReady students benefit:

Quick job placements in accounting firms

Higher starting salaries due to certified skills

Confidence in handling real-world payroll systems

Freelancing opportunities using Tally for small businesses

Many EarnReady alumni have successfully landed jobs right after completing the course—even with no experience.