Ultimate Guide: What is HR Payroll and Why It’s a Game-Changer for Businesses

Introduction

In today’s competitive job market, businesses are constantly looking for effective ways to manage their workforce. Payroll is one of the most critical yet often misunderstood parts of business operations. If you’re wondering what is HR payroll, you’re not alone. Understanding HR payroll is essential for smooth employee management, legal compliance, and building employee satisfaction—whether you’re an HR professional, business owner, or student.

What is HR Payroll?

What is HR payroll? In simple terms, it is the process through which an organization handles employee compensation. This includes calculating salaries, withholding applicable taxes and deductions, managing bonuses, and ensuring timely salary disbursement.

In addition to salary processing, HR payroll also involves regulatory filings, maintaining records, and managing employee benefits. It connects the HR and finance departments and plays a key role in managing staff and meeting legal obligations.

Payroll isn’t just about processing payments—it requires thorough knowledge of tax structures, financial laws, and HR policies. When done right, HR payroll boosts efficiency, transparency, and employee trust.

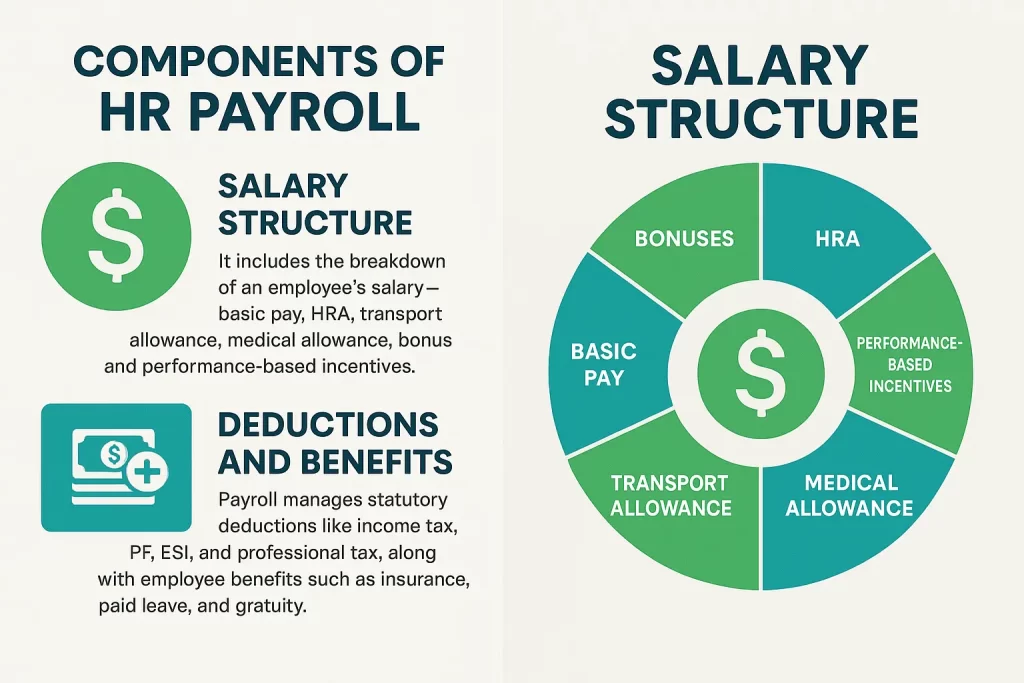

Components of HR Payroll

To understand what is HR payroll, it’s important to break it down into its core components. Payroll involves more than cutting cheques at the end of the month.

Salary Structure

The salary structure is the foundation of any payroll system. It consists of basic pay, House Rent Allowance (HRA), transport allowance, medical benefits, bonuses, and other incentives. A transparent salary structure ensures clarity and reduces confusion or conflict among employees.

Deductions and Benefits

Payroll also includes mandatory and voluntary deductions like:

Income Tax

Provident Fund (PF)

Employee State Insurance (ESI)

Professional Tax

Simultaneously, HR payroll involves managing benefits like health insurance, gratuity, paid time off, and retirement contributions. Accurate handling of these elements is essential for compliance and employee morale.

How HR Payroll Works in a Company

Understanding what is HR payroll means knowing the actual steps it involves within a company:

Data Collection – Gathering attendance, leave, and performance records.

Salary Calculation – Calculating gross and net salaries after deductions and taxes.

Disbursement – Transferring salaries to employee accounts on time.

Compliance Filing – Submitting TDS, PF, and ESI to government agencies.

Payslip Generation – Issuing payslips showing detailed salary breakdown.

Payroll typically runs monthly, but preparations begin weeks ahead. It requires strong coordination between HR, accounts, and IT teams.

Importance of HR Payroll in Business

If you’re still asking yourself what is HR payroll good for, the answer lies in its importance:

Legal Compliance – Helps fulfill tax obligations and labor laws.

Employee Trust – On-time, accurate salary boosts trust and engagement.

Operational Efficiency – Reduces errors and saves time through automation.

Reputation Management – Prevents penalties and ensures a good employer brand.

Financial Planning – Payroll data supports budgeting and cost control.

An efficient HR payroll system is a backbone of any growing business.

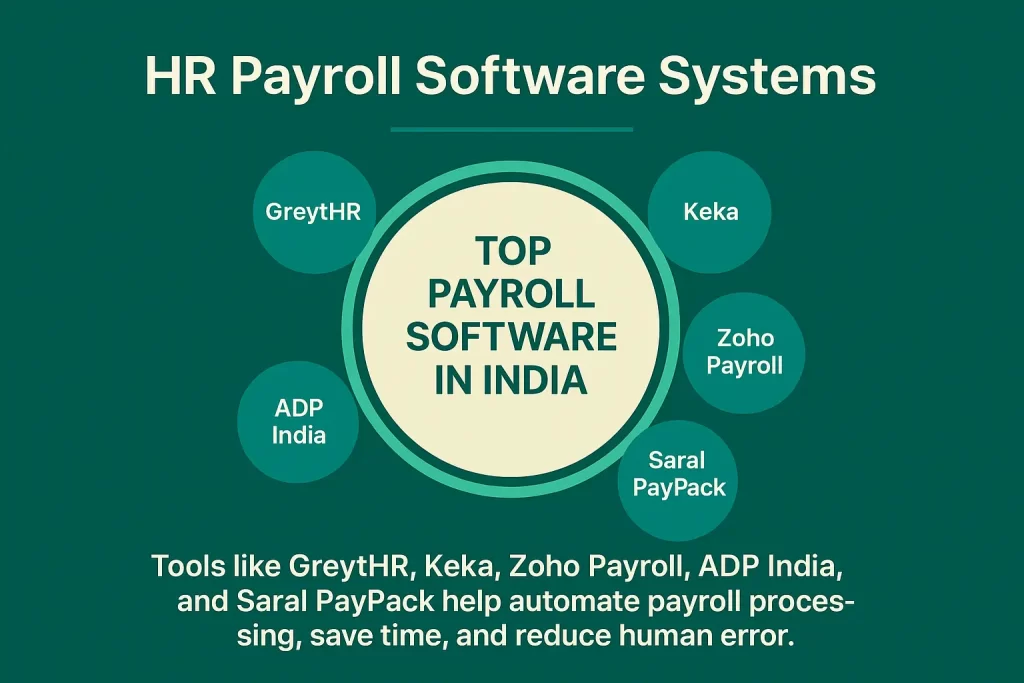

HR Payroll Software Systems

With digital transformation on the rise, manual payroll processes are being replaced with smart payroll software. Knowing what is HR payroll also means understanding the tools that make it work smoothly.

Top Payroll Software in India

GreytHR

Keka

Zoho Payroll

ADP India

Saral PayPack

These platforms help automate salary calculations, generate payslips, ensure tax compliance, and reduce errors.

You can explore more about payroll systems from this

Career Opportunities in HR Payroll

Once you understand what is HR payroll, you’ll realize how it unlocks lucrative career paths.

Popular Job Roles

Payroll Executive

HR Executive – Payroll

Payroll Analyst

Compensation & Benefits Manager

HRIS (Human Resources Information System) Specialist

Essential Skills

Strong knowledge of Indian labor laws and tax structures

Expertise in payroll software

Data analysis and reporting

High attention to detail

Strong communication and confidentiality

Certified payroll professionals are in high demand, especially in industries like IT, finance, and manufacturing.

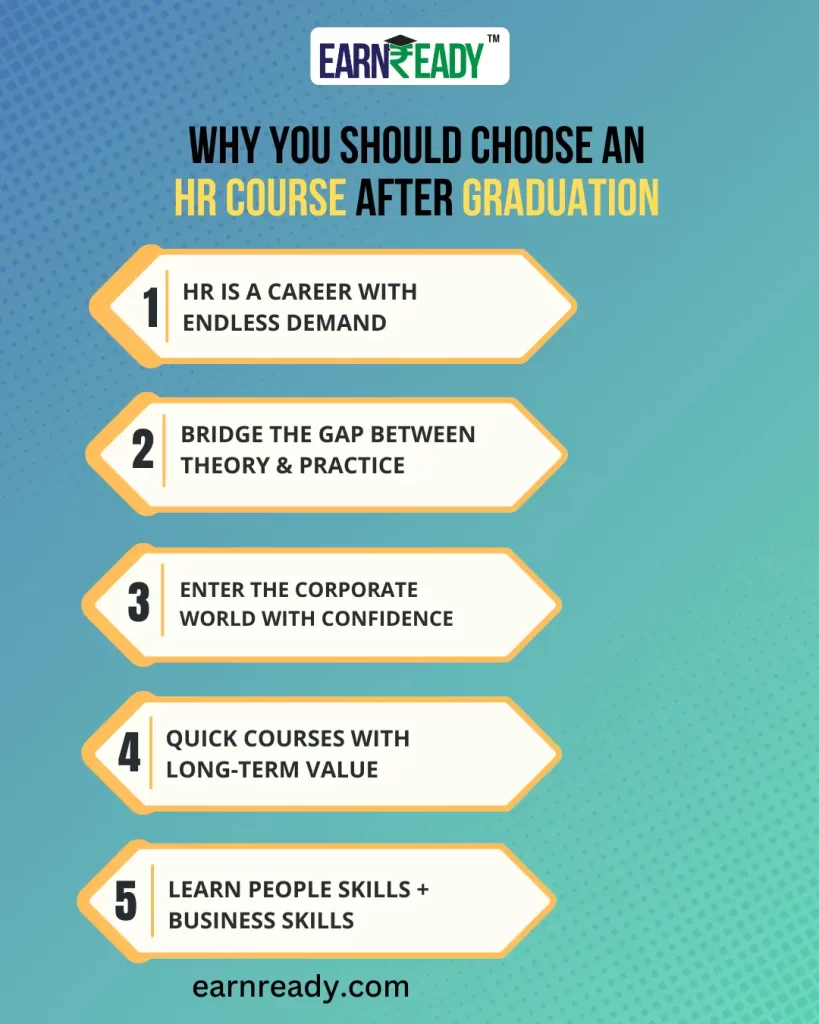

Learn HR Payroll with EarnReady

It’s not enough to just ask what is HR payroll—you need practical knowledge. That’s where EarnReady comes in. EarnReady offers India’s most practical HR course with payroll training tailored for job-readiness.

Course Highlights

Live classes with industry professionals

Hands-on training in Excel, Zoho Payroll, and Keka

Real case studies and assignments

Resume-building and interview prep

Guaranteed job placement support

Whether you’re a fresher or switching careers, EarnReady equips you with the skills employers want. Their training covers everything from basics to advanced payroll processing.