IATA Course in Mumbai: A Comprehensive Guide for Aspiring Aviation Professionals

IATA Course in Mumbai: A Comprehensive Guide for Aspiring Aviation Professionals

Mumbai, India’s bustling financial capital, is not only famous for its skyscrapers and vibrant culture but also for being one of the largest hubs for aviation and travel training. Among the most sought-after qualifications for anyone aspiring to work in the aviation industry is the International Air Transport Association (IATA) certification. Whether you want to work as an airline professional, travel consultant, or airport ground staff, an IATA certification can open numerous doors for your career. This guide will walk you through the essential details of enrolling in an IATA course in Mumbai and the career opportunities that follow.

The International Air Transport Association (IATA) is a global trade association for airlines. It represents 290 airlines worldwide and is known for providing various educational programs in aviation-related fields. IATA courses are globally recognized and help professionals gain industry-specific skills and knowledge.

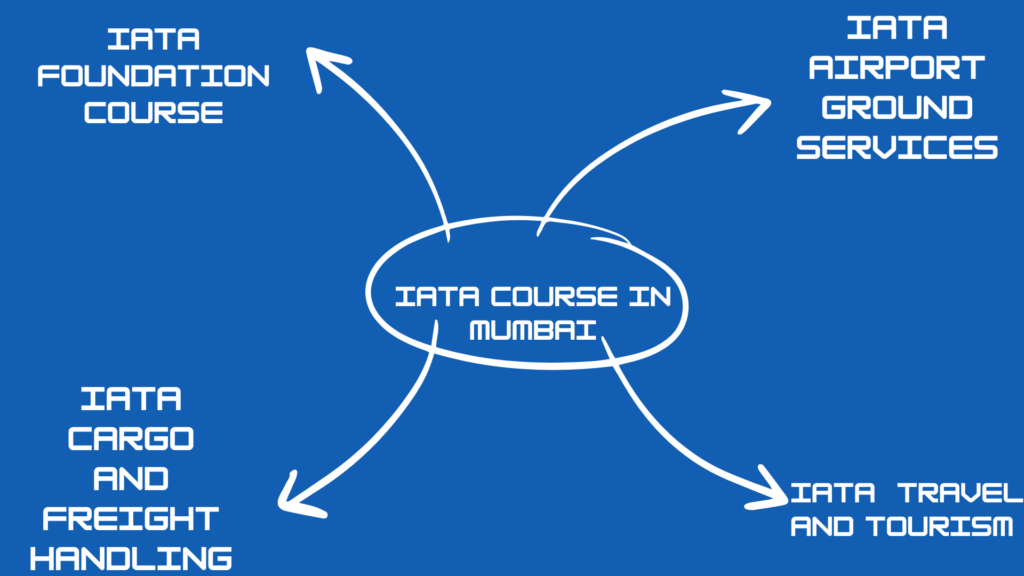

IATA offers different types of courses such as:

- IATA Foundation Course: Ideal for beginners in the aviation industry.

- IATA Travel and Tourism Course: Focuses on building expertise in travel agency operations.

- IATA Cargo Handling Course: Specializes in cargo and freight management.

- IATA Airport Ground Services: Teaches skills necessary for ground staff at airports.

Completing an IATA course can significantly enhance your employability and make you stand out in the competitive aviation job market.

What is an IATA Course?

Why Choose Mumbai for IATA Training?

Mumbai is the heart of India’s aviation industry. With its international airport, thriving tourism sector, and numerous airlines operating from the city, it is the ideal location for aspiring aviation professionals. Some key reasons to choose Mumbai for your IATA training include:

Key Benefits of IATA Certification

- Global Recognition: IATA-certified professionals are recognized worldwide, making it easier to find jobs in the global aviation industry.

- Skill Enhancement: The course helps you gain specialized skills in airport management, cargo handling, and travel consultancy.

- Job Placement: Many IATA institutes in Mumbai have tie-ups with top airlines and travel agencies, making it easier for graduates to secure job placements.

Competitive Edge: IATA certification adds credibility to your resume, giving you an edge over non-certified professionals.

IATA Course in Mumbai

Mumbai offers a wide range of IATA courses. Some of the most popular ones include:

- IATA Foundation Course: A comprehensive program that covers the basics of the aviation industry.

- IATA Airport Ground Services: Focuses on the skills needed to manage airport operations, from check-in procedures to baggage handling.

- IATA Travel and Tourism: Ideal for individuals seeking a career in travel agencies, providing insights into tour operations and ticketing.

IATA Cargo and Freight Handling: Offers specialized training in managing cargo logistics and freight forwarding.

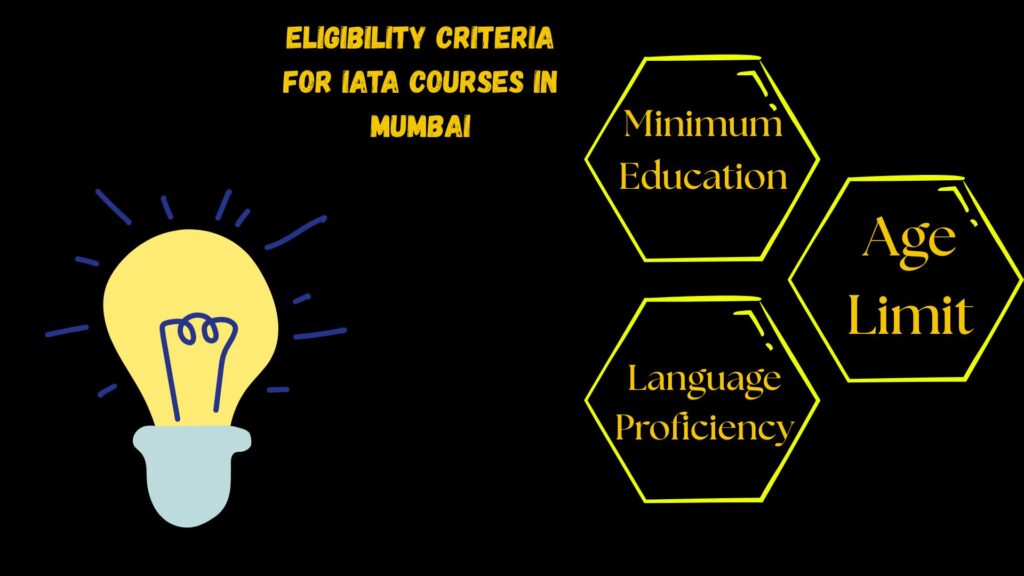

Eligibility Criteria for IATA Courses in Mumbai

IATA courses are open to anyone with a passion for the aviation industry. However, there are some basic eligibility criteria:

- Minimum Education: Most courses require candidates to have completed high school or its equivalent.

- Age Limit: While there is no strict age limit, candidates between 18-30 years are preferred for many courses.

Language Proficiency: Since IATA courses are conducted in English, candidates must have a basic understanding of the English language.

Duration and Cost of IATA Courses in Mumbai

The duration of IATA courses in Mumbai varies depending on the type of program. Typically:

- Short-term courses: Last between 4-6 months.

- Diploma programs: May take up to 12 months.

As for the cost, it varies by institute and course type. On average, an IATA course can cost anywhere between INR 30,000 to INR 1,50,000. Financial aid options are available at some institutes, including installment payment plans.

- Short-term courses: Last between 4-6 months.

What to Expect from an IATA Course in Mumbai

An IATA course in Mumbai offers a comprehensive learning experience. You can expect:

- In-depth Curriculum: Covering everything from basic aviation theory to specialized topics like cargo handling and airport management.

- Practical Experience: Many institutes provide hands-on training, including internships with airlines and travel agencies.

- Online vs Classroom: While some institutes offer online courses, classroom-based training often provides more direct interaction and networking opportunities.

- In-depth Curriculum: Covering everything from basic aviation theory to specialized topics like cargo handling and airport management.

How to Prepare for an IATA Course

Before enrolling, make sure you:

- Research Institutes: Ensure that the institute is accredited by IATA and has a solid reputation.

- Check the Curriculum: Review the course content to ensure it aligns with your career goals.

- Prepare Financially: Set aside the required funds and explore scholarship options.

IATA Certification: Is It Worth It?

While the cost of IATA certification can be high, it is a worthwhile investment for anyone serious about pursuing a career in aviation or travel. The global recognition and job prospects it offers make it a valuable credential in the competitive job market.