Ultimate Guide: How to Master Purchase Entry in Tally with GST for Seamless Accounting

Ultimate Guide: How to Master Purchase Entry in Tally with GST for Seamless Accounting

Table of Contents

- Introduction

- What is a Purchase Entry in Tally with GST?

- Why Purchase Entry with GST is Important in Tally

- Setting Up Tally for GST Accounting

- Creating Purchase Ledger in Tally

- Creating Supplier Ledger with GST Details

- Creating Stock Item for Purchase Entry

- Making a Purchase Entry in Tally with GST (Voucher Entry)

- Types of Purchase Transactions in Tally with GST

- Recording RCM Purchase Entry in Tally with GST

- Viewing GST Reports after Purchase Entries

- Common Mistakes While Recording Purchase Entry in Tally with GST

- How to Rectify a Wrong Purchase Entry in Tally with GST

- Practical Use Case: Purchase Entry in Tally with GST for Furniture Business

- Integration with E-Way Bill and GST Portal

- Why Tally is the Best Software for GST-Compliant Purchases

- Skills You Learn When You Practice Purchase Entry in Tally with GST

- Top Accounting Courses That Teach Purchase Entry in Tally with GST

- Best Practices for Efficient Purchase Entry in Tally with GST

- Useful Resources

Introduction

Understanding how to make a purchase entry in Tally with GST is one of the most essential skills for accounting professionals and business owners in India. Tally has become the go-to accounting software because of its simplicity and robust GST features. In this powerful guide, you’ll learn everything about managing purchases with GST in Tally, including setting up ledgers, GST configuration, and voucher entries.

Whether you’re a student, fresher, or an experienced accountant, this detailed walkthrough will make sure you never miss a step.

What is a Purchase Entry in Tally with GST?

A purchase entry in Tally with GST refers to recording a business transaction related to goods or services bought, ensuring that GST details like CGST, SGST, or IGST are accurately reflected in your books. This is vital for proper input tax credit and compliance with GST laws in India.

Why Purchase Entry with GST is Important in Tally

GST-compliant purchase entries help avoid legal issues and ensure your Input Tax Credit (ITC) claims are valid. Here’s why:

Accurate tax filing

Avoidance of penalties

Real-time ITC monitoring

Better inventory control

Setting Up Tally for GST Accounting

Before making a purchase entry in Tally with GST, ensure your software is properly configured.

Step 1: Enable GST in Tally

Go to F11: Features > Statutory & Taxation

Set Enable Goods and Services Tax (GST) to Yes

Enter your GSTIN, State, and Applicable Period

Step 2: Create GST Ledger Accounts

Create the following ledgers:

CGST (Under Duties & Taxes)

SGST (Under Duties & Taxes)

IGST (Under Duties & Taxes)

Make sure to choose GST as the type of duty/tax and specify the relevant tax rate.

Creating Purchase Ledger in Tally

A proper purchase ledger setup is crucial for any purchase entry in Tally with GST.

Gateway of Tally > Accounts Info > Ledgers > Create

Name: Purchase @ 18%

Under: Purchase Accounts

Set GST Applicable to Yes

Specify the tax rate (e.g., 18%)

Creating Supplier Ledger with GST Details

Tally allows you to store GST information of vendors, helping with GSTR-2A reconciliation.

Steps:

Gateway of Tally > Accounts Info > Ledgers > Create

Name: ABC Traders

Under: Sundry Creditors

Set GST Registration Type: Regular

Enter GSTIN and State

Creating Stock Item for Purchase Entry

Stock items are linked to the GST tax rate, which is pulled automatically during purchase entry.

Gateway of Tally > Inventory Info > Stock Item > Create

Name: Office Chairs

Units: Nos

GST Rate: 18%

Making a Purchase Entry in Tally with GST (Voucher Entry)

Now that setup is complete, here’s how to pass the purchase entry in Tally with GST:

Steps:

Go to Gateway of Tally > Accounting Vouchers > F9: Purchase

Select supplier ledger (e.g., ABC Traders)

Add stock item (e.g., Office Chairs)

Enter quantity, rate, and amount

GST will be automatically calculated

Select the applicable CGST and SGST or IGST ledger

Save the voucher

This voucher records your purchase along with GST details, making it a complete transaction.

Types of Purchase Transactions in Tally with GST

There are different purchase types you may need to record, depending on GST applicability:

1. Intra-State Purchase (CGST + SGST)

Supplier and buyer in the same state

CGST and SGST ledgers will be used

2. Inter-State Purchase (IGST)

Supplier and buyer in different states

IGST ledger will be used

3. Reverse Charge Mechanism (RCM)

Applicable for unregistered dealer purchases

Both purchase and tax liability are recorded by buyer

Recording RCM Purchase Entry in Tally with GST

To record a reverse charge purchase entry in Tally with GST, follow these:

Create Purchase Ledger: RCM @ 18%

Use F9: Purchase > Select Unregistered Supplier

Manually enter CGST/SGST or IGST

Record liability and tax payment later via Journal

Viewing GST Reports after Purchase Entries

Tally offers multiple GST reports that help track purchases and tax liability.

Path: Display > Statutory Reports > GST > Purchases

You can view:

GSTR-2

Input Tax Credit

GST Summary

These reports are updated automatically after each purchase entry in Tally with GST.

Common Mistakes While Recording Purchase Entry in Tally with GST

Avoid these errors:

Wrong GST rate in ledger

Incorrect supplier GSTIN

Misclassification of intra/inter-state

Not enabling GST in ledgers

Each of these can impact your ITC and lead to errors in GSTR returns.

How to Rectify a Wrong Purchase Entry in Tally with GST

If you make an incorrect entry:

Go to Daybook

Locate the transaction

Press Enter to open the voucher

Make corrections

Save

This real-time correction helps maintain accuracy in your financial records.

Practical Use Case: Purchase Entry in Tally with GST for Furniture Business

Let’s assume you’re buying office desks from a registered vendor in the same state.

Details:

Supplier: Office Mart

Item: Office Desk

Quantity: 10

Rate: ₹3000

GST Rate: 18% (CGST 9% + SGST 9%)

Voucher Entry Steps:

F9: Purchase

Party: Office Mart

Item: Office Desk – Qty: 10 – Rate: ₹3000

GST Auto Calculates

Select CGST @ 9% and SGST @ 9%

Save

Integration with E-Way Bill and GST Portal

Integrating Tally with e-Way Bill Generation for High-Value Purchases

For businesses handling high-value purchases, ensuring compliance with GST regulations is crucial. One of the key requirements under the GST regime is the generation of an e-Way Bill for the movement of goods exceeding the specified threshold. Tally, as a powerful accounting and ERP software, offers seamless integration with e-Way Bill generation, making the process both efficient and compliant.

Here are the detailed steps to enable and use this feature:

1. Enable e-Way Bill in GST Setup

Before you can begin generating e-Way Bills through Tally, you must enable the option within the GST setup of the software. To do this:

Navigate to F11 > Statutory & Taxation in Tally.

Enable Goods and Services Tax (GST).

Set Enable e-Way Bill to “Yes”.

Configure the threshold value as per the applicable state laws or business requirements.

This setup ensures that Tally prompts you for necessary e-Way Bill details whenever the transaction meets the criteria.

2. Enter Required Details During Voucher Entry

While recording a purchase voucher, especially for high-value goods, it is essential to fill in all required fields that are necessary for generating an e-Way Bill. These include:

Distance: Specify the approximate distance in kilometers between the supplier and the recipient’s location. This helps determine the validity period of the e-Way Bill.

Vehicle Number: Enter the mode of transportation and the vehicle number used to transport the goods. This is a mandatory field for goods being transported by road.

Document Date: This refers to the date of the invoice or bill associated with the transaction. It must be accurate to avoid any discrepancies during compliance checks.

Tally allows you to input these details directly in the voucher screen, streamlining the process and reducing manual errors.

3. Generate and Manage e-Way Bills Effortlessly

Once the above information is entered correctly, Tally can either generate the e-Way Bill directly (if integrated with the e-Way Bill portal via APIs) or export the data in a JSON format for upload to the portal manually.

This integration ensures that:

You remain compliant with GSTN regulations at all times.

There is no delay or penalty due to missing or incorrect e-Way Bill details.

Your business maintains a smooth flow of goods and documentation, improving operational efficiency.

Why Tally is the Best Software for GST-Compliant Purchases

Simplifying GST-Compliant Purchase Entries with TallyPrime

Managing purchases under the Goods and Services Tax (GST) regime can be a complex task, especially for businesses dealing with multiple suppliers, locations, and tax rates. However, TallyPrime has been designed to simplify this process with a range of intuitive features that make purchase entry not only easy but also fully compliant with GST regulations. Whether you are a small startup or a large enterprise, TallyPrime caters to businesses of all sizes by streamlining every aspect of GST accounting.

1. Easy Setup for GST Compliance

Getting started with GST in TallyPrime is straightforward. The software provides a guided configuration process that allows users to enable GST features with just a few clicks. You can:

Activate GST at the company level.

Configure GST details for suppliers and items.

Set default tax rates and HSN/SAC codes.

Create tax ledgers for CGST, SGST, IGST, and cess.

This quick setup ensures that your business is GST-ready from day one without the need for extensive technical knowledge or third-party assistance.

2. Automatic GST Calculations

Once GST is configured, TallyPrime handles tax calculations automatically during purchase entry. When you record a purchase invoice:

The applicable GST rates are auto-applied based on the item and party details.

The system intelligently determines whether the transaction is intra-state (CGST & SGST) or inter-state (IGST).

Tax breakup is shown clearly for easy verification.

This automation eliminates manual errors, ensures accurate bookkeeping, and saves valuable time during data entry.

3. GSTR-Ready Reports at Your Fingertips

TallyPrime comes equipped with pre-configured reports that are fully aligned with GST returns such as GSTR-1, GSTR-2A reconciliation, GSTR-3B, and more. These reports are:

Auto-populated based on transaction data.

Structured to match the format required by GSTN.

Easily exportable in JSON format for direct upload to the GST portal.

With these reports, businesses can file their returns confidently, knowing that the data is accurate and complete.

4. Real-Time Input Tax Credit (ITC) Tracking

One of the critical aspects of GST is managing Input Tax Credit. TallyPrime provides real-time tracking of ITC to help businesses:

Monitor eligible and ineligible credits.

Match ITC claims against supplier invoices.

Avoid ITC mismatches that could lead to notices or penalties.

This feature is especially helpful in maintaining healthy cash flow and reducing tax liabilities effectively.

5. Support for Multiple GST Scenarios

TallyPrime is built to handle a wide variety of GST scenarios, making it a powerful tool for businesses that operate across different states or deal with diverse tax rates. It supports:

Multiple GST registrations (GSTINs) under a single company.

Branch-level GST tracking and reporting.

Composite and regular dealer schemes.

Reverse charge mechanism (RCM).

E-commerce and export transactions.

No matter how complex your GST requirements are, TallyPrime provides the flexibility to manage them with ease.

Skills You Learn When You Practice Purchase Entry in Tally with GST

Practicing this daily builds skills in:

GST compliance

Voucher handling

Ledger accuracy

Statutory reporting

Inventory linking

These are in-demand skills for accounting and finance jobs in India.

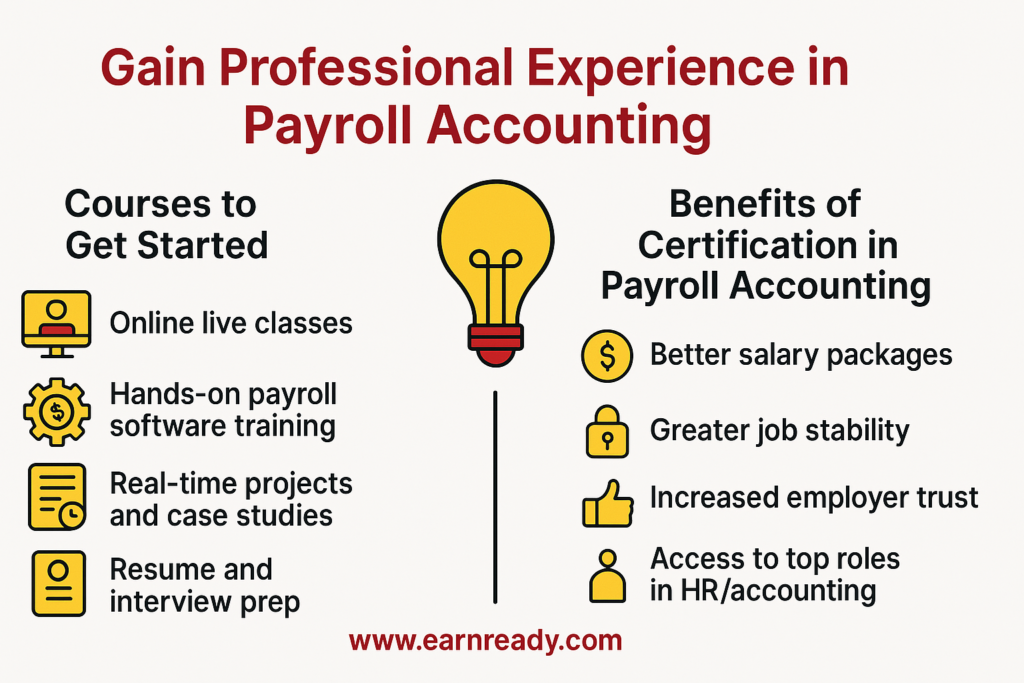

Top Accounting Courses That Teach Purchase Entry in Tally with GST

You can master this skill with the best Tally GST training programs. One such recommended platform is EarnReady, which provides real-world projects, practical assignments, and job assistance.

Best Practices for Efficient Purchase Entry in Tally with GST

Always validate GSTIN of suppliers

Maintain separate ledgers for different GST rates

Reconcile purchase reports monthly

Backup your Tally data

Use authorized software versions