HR Payroll Jobs: A Smart Career Choice for a Stable Future

HR Payroll Jobs: A Smart Career Choice for a Stable Future

Introduction

Payroll is one of the most crucial processes in any company — yet it’s often misunderstood.

It’s not just about paying salaries. Payroll ensures legal compliance, boosts employee satisfaction, and supports the smooth functioning of HR. A quality HR payroll course helps professionals master this complex task and opens the door to high-paying HR payroll jobs.

With the right skills, you can access HR payroll jobs in top organizations that value accuracy and transparency. These roles are in high demand, especially for those trained in compliance, incentive structures, and payroll software.

Whether you’re new to HR or looking to grow, earning certification increases your chances of landing top-tier HR payroll jobs.

Professionals trained through EarnReady are prepared for HR payroll jobs that require both strategic thinking and operational excellence.

What Are HR Payroll Jobs?

HR payroll jobs involve managing the payroll process from start to finish. This includes calculating salaries, deducting taxes, handling employee benefits, and submitting returns to government departments. These professionals act as the bridge between HR, finance, and compliance departments.

Common roles in HR payroll jobs include:

Payroll Executive

HR Operations Executive

Payroll Specialist

HR & Payroll Analyst

Compensation and Benefits Manager

Each role focuses on different aspects of payroll management, but all require attention to detail, legal knowledge, and good communication skills.

What Do HR Payroll Professionals Do?

Salary Calculation

Professionals calculate gross and net salary based on attendance, leaves, overtime, and bonuses. This process requires knowledge of tax laws, provident fund rules, and standard payroll practices.

Tax Deduction and Compliance

They ensure timely deduction and deposit of:

TDS (Tax Deducted at Source)

EPF (Employees’ Provident Fund)

ESI (Employees’ State Insurance)

Professional Tax

Payroll Software Management

Modern payroll is handled through software such as GreytHR, Keka, or RazorpayX Payroll. HR payroll professionals must know how to use these tools for smooth salary processing and report generation.

Payslip Generation and Record Maintenance

They are responsible for generating payslips, maintaining payroll records, and ensuring accurate documentation for audits or inspections.

Statutory Filings

HR payroll professionals file returns with government departments and make sure the company stays compliant with all employment laws.

Skills Needed for HR Payroll Jobs

To succeed in HR payroll jobs, professionals must develop a balanced combination of technical expertise and soft skills. These roles demand precision, compliance knowledge, and strong interpersonal capabilities to manage one of the most sensitive areas of HR — employee compensation.

A key requirement for thriving in HR payroll jobs is in-depth knowledge of payroll software. Systems like GreytHR, Keka, RazorpayX, and others are commonly used to manage employee data, process salaries, generate payslips, and file statutory returns. Familiarity with these platforms not only enhances efficiency but also minimizes errors.

Another essential area is a strong understanding of tax laws and labor regulations. Professionals must stay updated with changes in TDS rules, ESI and EPF deductions, professional tax, and other statutory compliance requirements. Mastery of these regulations ensures that payroll is processed legally and on time, which is critical in HR payroll jobs.

Proficiency in Microsoft Excel is another highly valued skill. Whether it’s for preparing reports, analyzing payroll data, or maintaining records, Excel is a vital tool used daily in most HR payroll jobs. Knowledge of formulas, pivot tables, and data validation can make payroll processing smoother and faster.

Attention to detail is a non-negotiable trait. Even a small error in salary disbursement or tax calculation can lead to legal issues or employee dissatisfaction. Therefore, professionals in HR payroll jobs must be highly meticulous and double-check every detail.

Equally important are time management and organizational skills. Payroll follows a strict monthly schedule, and delays are not an option. HR payroll professionals must be able to manage multiple tasks, meet deadlines, and handle unexpected situations calmly and efficiently.

Lastly, confidentiality and integrity are crucial. Payroll professionals handle sensitive information about employee compensation, tax status, and personal details. Maintaining confidentiality and demonstrating ethical behavior are core requirements in HR payroll jobs.

A well-structured HR payroll course can provide the knowledge, tools, and hands-on training needed to master all of these skills. Whether you are just starting or looking to upskill, investing in such a course can significantly improve your chances of success and career growth in the field of HR payroll jobs.

How to Get HR Payroll Jobs

Step 1: Get the Right Training

Start by enrolling in a recognized HR payroll course like the one offered by EarnReady. This course covers:

Basics of HR and payroll

Salary structure and tax deductions

Hands-on training on payroll software

Case studies and real-time payroll scenarios

Step 2: Build Experience

Many companies offer internships or entry-level roles in HR or payroll. Use these to gain practical experience and develop your resume.

Step 3: Prepare for Interviews

Learn common payroll interview questions like:

How do you calculate net salary?

What is the current PF contribution rate?

Which payroll software have you used?

How do you ensure compliance?

Mock interviews and resume building support from EarnReady can help you feel confident.

Step 4: Apply Smartly

Target companies in sectors like:

IT & Software

Manufacturing

Healthcare

Banking and Finance

E-commerce

These industries frequently hire payroll professionals due to their large and growing workforces

Salary Expectations in HR Payroll Jobs

Here’s what you can expect as salary in India for HR payroll jobs:

Entry-Level (0–2 years): ₹2.5 – ₹4.5 LPA

Mid-Level (2–5 years): ₹4.5 – ₹7 LPA

Senior-Level (5+ years): ₹7 – ₹12 LPA

Additional certifications and experience with advanced payroll systems can increase your earning potential.

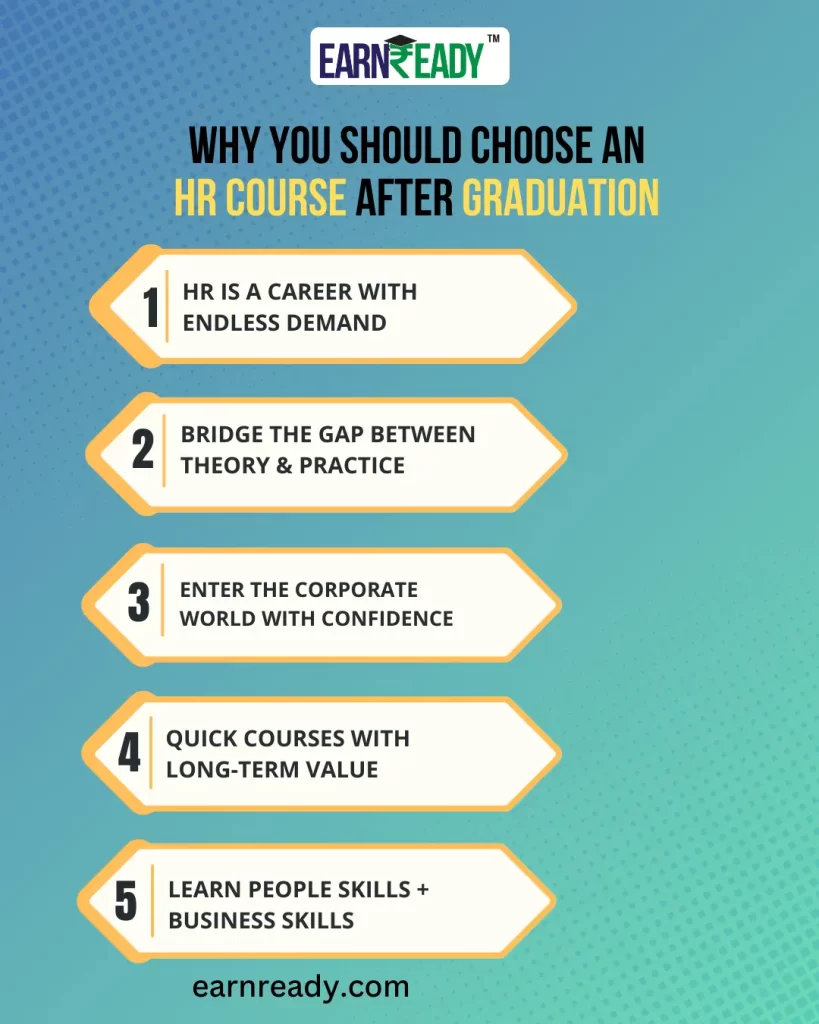

Why Choose HR Payroll Jobs?

High Demand

Every business with employees needs payroll professionals. With rising compliance requirements, companies are expanding their HR payroll teams.

Stability

Payroll is a recurring process and companies prioritize it. This makes payroll jobs more stable compared to many other corporate roles.

Career Growth

You can start as a payroll executive and grow to become an HR Manager, Payroll Head, or Compensation and Benefits Manager.

Diverse Opportunities

HR payroll jobs are available across industries, giving you the flexibility to work in your area of interest — whether it’s IT, retail, or healthcare.

Tools Used in HR Payroll Jobs

To be successful, you should be familiar with popular tools such as:

GreytHR

Zoho Payroll

RazorpayX

Keka HRMS

QuickBooks Payroll

These platforms simplify payroll processing and reduce the chances of manual errors.

Learn Payroll with EarnReady

EarnReady offers a job-focused HR payroll course that helps you land your dream payroll job. Their features include:

Real-world payroll training

Software-based sessions

Experienced mentors

Resume and interview preparation

Placement support

With EarnReady, you don’t just learn payroll — you become job-ready.

Real-Life Use Case: How Payroll Affects a Company

Imagine a company that misses payroll deadlines. Employees lose trust, morale drops, and talent starts leaving. On the other hand, when payroll is processed accurately and on time, employees feel valued, work harder, and speak positively about the company.

This shows how important HR payroll professionals are — they are the silent heroes behind employee satisfaction and compliance.

Do I need an MBA to get HR payroll jobs?

Is payroll part of HR or finance?

Can freshers get HR payroll jobs?

Importance of HR Payroll in Business: A Must-Know for Every HR Professional

Importance of HR Payroll in Business: A Must-Know for Every HR Professional

Introduction

Payroll is more than just processing salaries—it’s the backbone of employee satisfaction and legal compliance. A well-managed payroll system ensures that employees are paid accurately and on time, boosting morale and trust within the company. But beyond payments, payroll also involves managing taxes, statutory deductions, benefits, and reporting—all of which are critical for legal and financial accuracy.

For businesses, especially startups and growing companies, payroll errors can lead to penalties, employee dissatisfaction, and even reputational damage. That’s why having skilled payroll professionals is vital. They not only keep the company compliant with ever-changing labor laws but also optimize payroll processes for better efficiency.

Enrolling in an HR payroll course is a game-changer for anyone looking to enter or advance in the HR field. These courses offer hands-on training in payroll software, tax regulations, salary structuring, and compliance. You’ll gain practical knowledge that employers highly value—making you a reliable and skilled asset to any organization.

Whether you’re a recent graduate, a working professional, or someone looking to switch careers, ancourse equips you with the expertise to manage one of the most important functions in any business. It’s not just a course—it’s your pathway to becoming a trusted payroll expert.

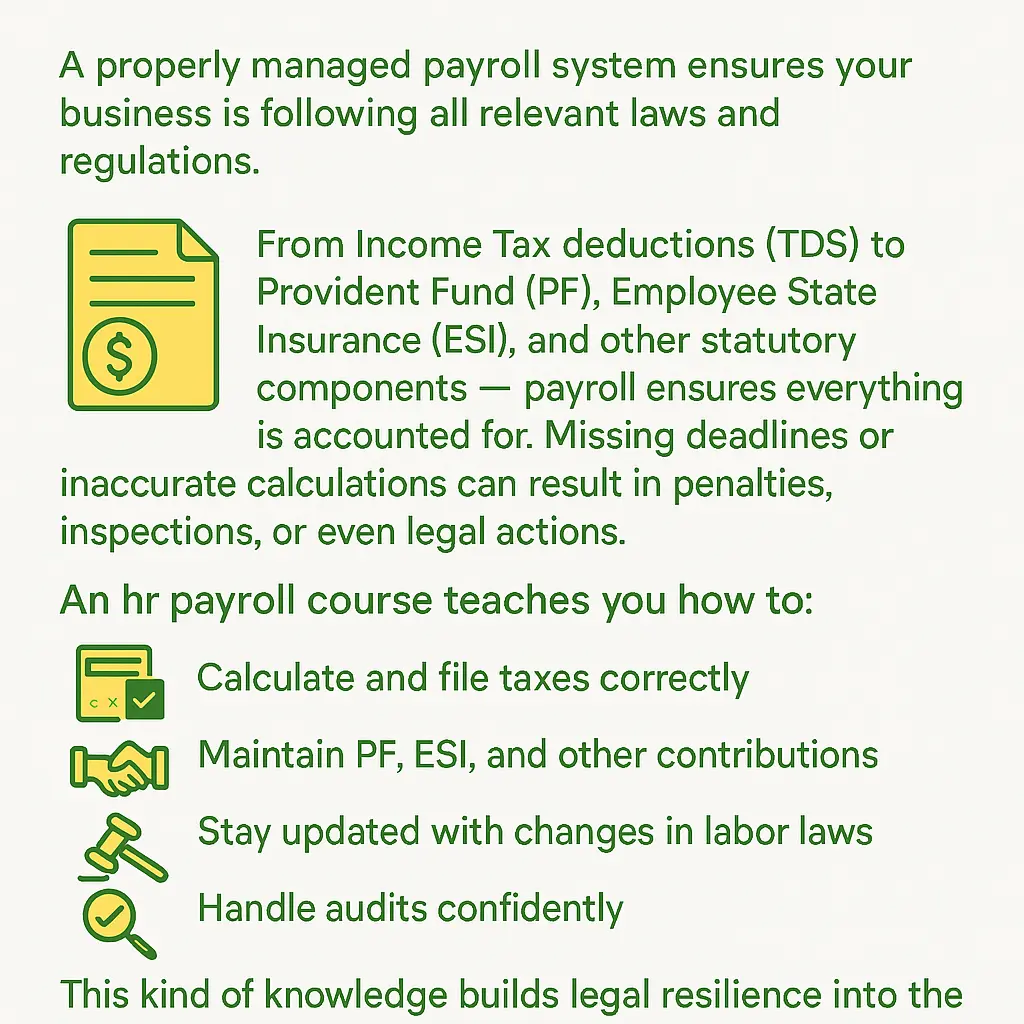

Legal Compliance

A properly managed payroll system ensures your business stays compliant with all applicable laws and regulations. It’s not just about issuing salaries—it’s about maintaining financial and legal discipline. From calculating Income Tax deductions (TDS) to managing contributions like Provident Fund (PF) and Employee State Insurance (ESI), every component must be accurately handled. Mistakes in payroll processing can lead to missed deadlines, government penalties, surprise audits, or even legal action, all of which can damage the company’s reputation and bottom line.

This is where an HR payroll course becomes invaluable. These courses are designed to teach you how to:

Calculate and file taxes correctly, ensuring timely payments and accurate TDS deductions

Maintain PF, ESI, and other statutory contributions, which are essential for employee benefits and compliance

Stay updated with changes in labor laws, so you’re never caught off-guard by new rules or amendments

Handle audits confidently, with complete and well-organized payroll documentation

By mastering these areas, you build legal resilience into the company. A well-trained payroll professional ensures smooth, error-free operations and shields the organization from unnecessary financial and legal risk. Investing in this expertise through an HR payroll course is not just smart—it’s essential.

Employee Trust

Employees expect their salary to be processed accurately and on time, every single month. It’s not just a financial transaction—it’s a reflection of how much the company values and respects its workforce. When salaries are delayed or deductions appear unclear, it leads to frustration, lowered morale, and a breakdown in trust between employees and management.

A well-structured payroll system ensures:

Timely salary disbursement, which boosts employee satisfaction and motivation

A clear breakdown of earnings and deductions, so employees understand exactly how their salary is calculated

Regular issuance of payslips, providing a transparent record of salary, taxes, and benefits

Transparency in bonuses, reimbursements, and incentives, reinforcing fairness and accountability

When payroll is managed efficiently, it strengthens employee confidence and enhances workplace culture. A transparent and error-free payroll process reassures employees that they’re being treated fairly and professionally.

An HR payroll course equips professionals with the skills to manage these responsibilities with precision. From leave tracking to overtime and incentive calculations, the course trains you to handle real-time payroll scenarios. This knowledge not only ensures accuracy but also builds trust between employees and the organization—making payroll management a key driver of employee morale and retention.

Financial Planning

Payroll data is crucial for accurate financial forecasting and effective cost control. In any organization, understanding the full scope of HR is key to managing manpower expenses wisely. HR insights allow businesses to evaluate the true cost of their workforce, from monthly salaries to additional statutory expenses such as Provident Fund (PF), Gratuity, and Employee State Insurance.

One of the major benefits of mastering HR data is its role in budgeting for new hires. When expanding a team, companies need clear visibility into current and projected payroll expenses. Similarly, HR analysis supports calculating annual raises, bonuses, and other compensation adjustments in a financially sustainable way.

Without proper practices, businesses often face unplanned costs or poorly allocated funds. That’s why comprehensive payroll training programs include modules on budgeting, forecasting, and payroll reporting. These tools not only ensure compliance but also enhance financial efficiency.

payroll analytics empower HR professionals and finance teams to make smarter, data-driven decisions. With a firm grasp of HR metrics, companies can align their human capital strategy with long-term business goals. In today’s competitive environment, understandingis more than an administrative task—it’s a strategic advantage.

Reputation Management

In today’s connected and fast-paced business world, even a single payroll error can significantly damage a company’s reputation—both internally with employees and externally with the public. A delayed salary, tax miscalculation, or missed compliance filing can trigger a cascade of negative outcomes. These may include poor reviews on job portals, a rise in employee resignations, government-imposed fines or audits, and even a loss of investor trust.

That’s why HR payroll accuracy is not just a back-office concern—it’s a frontline issue that impacts brand reputation and employee satisfaction. Organizations that prioritize management reduce the risk of such damaging errors. Skilled professionals trained in HR payroll are essential to ensuring timely salary processing, accurate tax deductions, and full statutory compliance.

Many companies now recognize the importance of investing in talent. Enrolling HR professionals in a certified HR payroll course provides them with the tools and knowledge to manage payroll operations with precision. From understanding tax regulations to mastering payroll software, these courses are designed to build expertise in all aspects .

Ultimately, a strong system supports smooth internal processes and maintains a company’s credibility. In today’s competitive market, mastering HR payroll is a smart move toward long-term success.

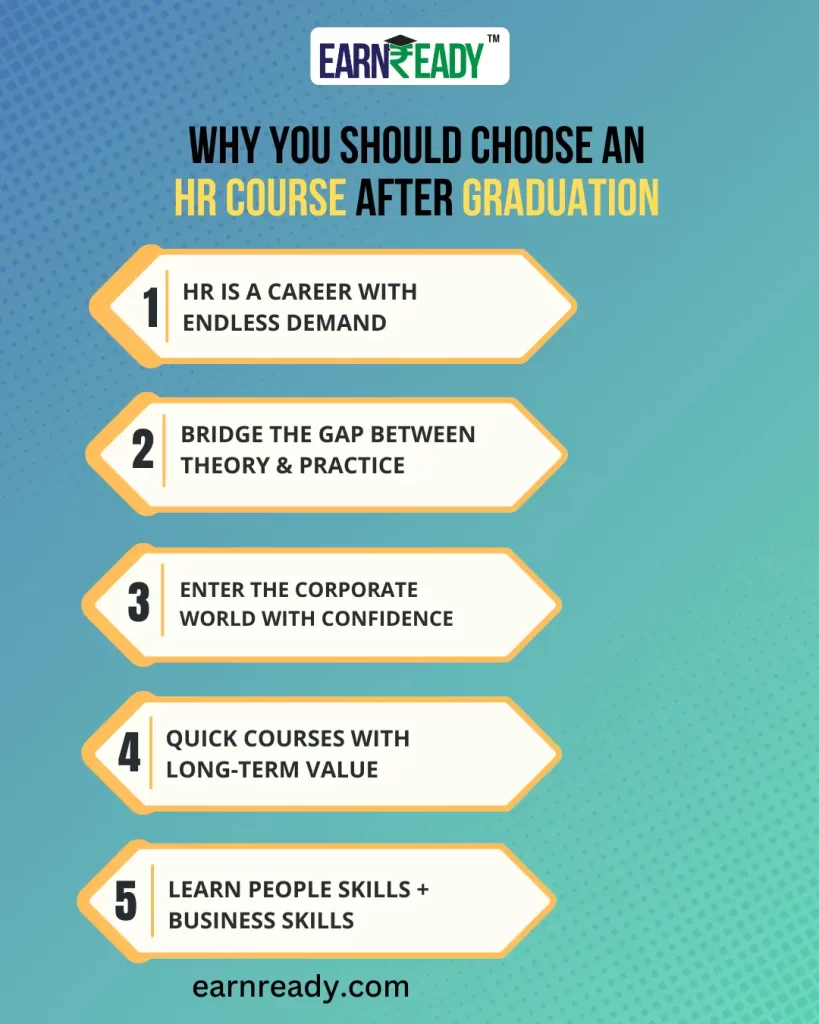

Why Learn Payroll?

Still wondering why you should invest in an payroll course? Here are some powerful reasons that make it a smart career move—whether you’re starting out in HR or looking to specialize.

HIGH DEMAND FOR PAYROLL SKILLS

Every business, big or small, relies on accurate payroll processing. With increasing focus on labor laws and compliance, skilled HR professionals are in constant demand. Companies actively seek individuals with HR expertise to manage complex pay structures, taxes, and employee benefits.

BETTER CAREER OPPORTUNITIES

An HR payroll course equips you with niche skills that are valued in both HR and finance departments. Whether you’re aiming for a corporate HR role or a payroll analyst position, mastering HR payroll can lead to better salaries and faster promotions. It’s a career path that blends administration, compliance, and financial acumen.

REAL-WORLD PAYROLL TOOLS

Top HR courses provide hands-on training with tools like Zoho Payroll, GreytHR, and Excel automation. Learning how to use these tools efficiently makes you job-ready across industries.

LEGAL CONFIDENCE

With the right HR payroll training, you’ll understand tax filing, deduction management, and legal compliance—skills that reduce company risk and boost your professional credibility.

An payroll course isn’t just education—it’s career empowerment.

Learn from the Best: EarnReady HR Payroll Course

Looking for a practical and job-oriented HR payroll course? EarnReady offers everything you need to build a strong foundation and launch a successful career in payroll management.

With real-time payroll processing training, you’ll gain hands-on experience in managing salary structures, deductions, and statutory compliance. The course includes case studies on tax filing, PF, and ESI—giving you the confidence to handle real-world scenarios that HR payroll professionals face every month.

EarnReady’s HR payroll course also comes with certification and 100% job assistance, making it ideal for freshers and working professionals looking to upskill. You’ll get exposure to live payroll software like Zoho Payroll and GreytHR, which are widely used across industries, ensuring you’re job-ready from day one.

In addition to technical payroll skills, the course supports your career journey with resume building and interview preparation sessions. This combination of practical training and career support gives you a competitive edge in the job market.

Whether you’re starting your career or upgrading your skills, EarnReady’s HR course is designed to help you master payroll and secure better opportunities. With expert guidance and real-world practice, you’ll become the go-to payroll expert every company needs.

Who Should Take an HR Payroll Course?

If you’re wondering who can benefit the most from an HR course, the answer is—almost anyone looking to grow in the HR or finance domain.

HR freshers who are just starting their careers can use an HR course to gain a valuable specialization. It helps them stand out in interviews by demonstrating practical knowledge of payroll processing, tax deductions, and compliance—skills that are in high demand.

Finance graduates often seek a niche skill to complement their degree. Learning HR gives them a unique edge, as it combines financial knowledge with practical HR functions, opening up roles in payroll analysis, HR operations, and compliance management.

MBA (HR) students preparing for placements will find that adding to their skill set makes them more competitive. Recruiters often prefer candidates who understand not just HR theory but also have hands-on experience with payroll systems and statutory requirements.

Working professionals aiming for promotions or a role switch into HR operations, compensation & benefits, or payroll management can benefit immensely from specialized HR payroll training.

In short, an course is a strategic investment for anyone who wants to grow, specialize, or transition in their career with confidence and competence.

Will I get practical training?

What is the salary scope?

Do I need prior experience?

Mastering Payroll Accounting: What is Payroll Accounting and Why It Matters in Business

Mastering Payroll Accounting: What is Payroll Accounting and Why It Matters in Business

Table of Contents

- Introduction to Payroll Accounting

- Key Components of Payroll Accounting

- Payroll Accounting Process Explained

- Payroll Accounting vs. General Accounting

- Common Payroll Accounting Software

- Challenges in Payroll Accounting

- Career Opportunities in Payroll Accounting

- Learn Payroll Accounting Professionally

- FAQs about Payroll Accounting

Introduction

In the evolving world of business management, payroll remains a critical aspect that directly affects employee satisfaction and legal compliance. But many still wonder — what is payroll accounting? It goes beyond simply paying salaries. A structured financial system known as payroll accounting keeps businesses in compliance with labor and tax laws while also ensuring that employees are paid accurately and promptly. Understanding what is payroll accounting is essential for HR professionals, accountants, business owners, and aspiring job seekers aiming to enter the finance or human resources industry.

What exactly is payroll accounting?

The term “payroll accounting” is used to describe the process of keeping track of, managing, and recording employee compensation, such as wages, bonuses, tax deductions, and so on. It ensures that tax obligations are met without error and that employees are paid appropriately. Gross wages are calculated, deductions are subtracted, tax reports are filed, and each transaction is recorded in the company’s financial records as part of payroll accounting. Knowing what is payroll accounting allows businesses to maintain transparency and legal compliance.

Why is Payroll Accounting Important for Businesses?

Understanding what is payroll accounting helps in realizing its business significance. It plays a major role in:

Ensuring accurate payment to employees

Preventing legal penalties through tax compliance

Fostering employee confidence

Keeping accurate financial records

Fines, employee dissatisfaction, and legal issues are all possible outcomes for businesses that neglect or mishandle payroll accounting that’s why understanding what is payroll accounting is important.

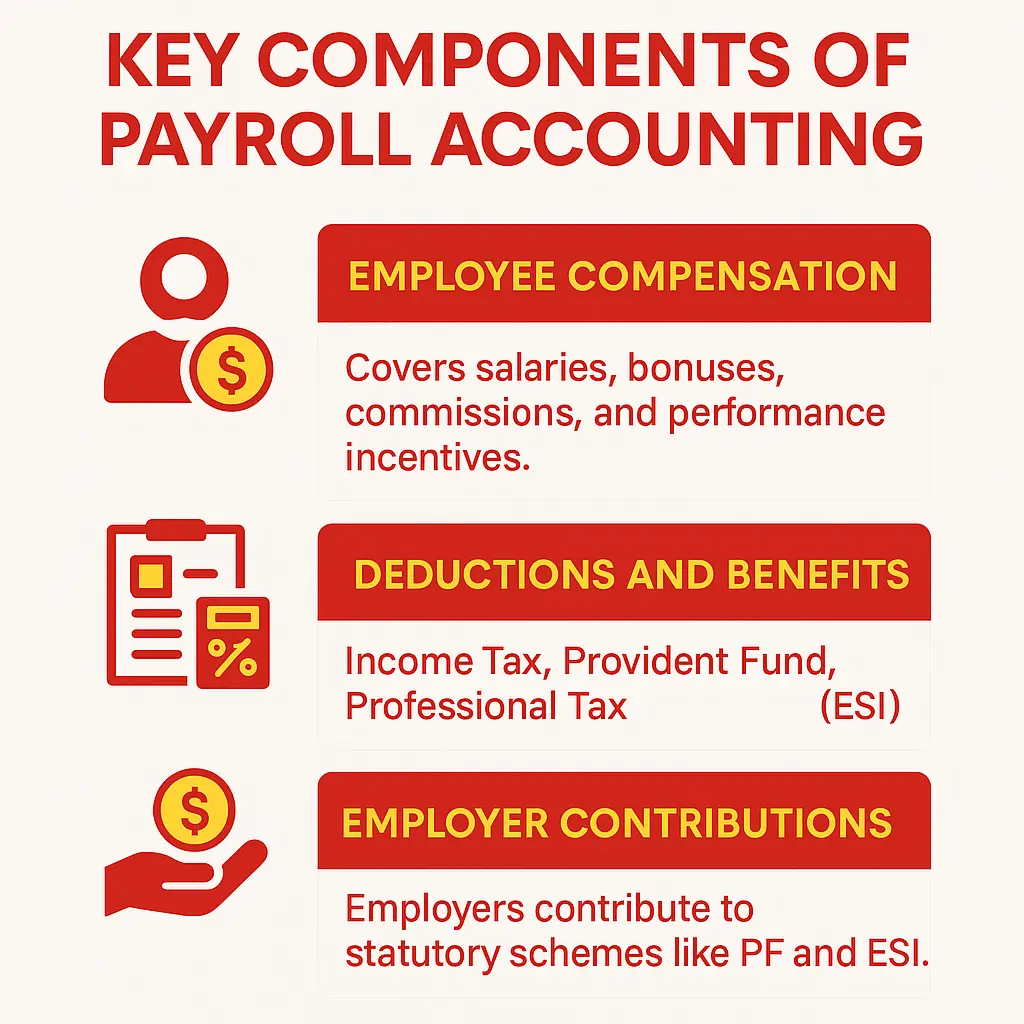

Key Components of Payroll Accounting

Employee Compensation

Employee compensation is the foundation of payroll accounting. It includes commissions, performance bonuses, overtime pay, basic salary, and other benefits. Accurately recording these elements ensures compliance with labor laws and fairness to employees.

Deductions and Benefits

Payroll accounting manages various statutory and voluntary deductions such as:

Income Tax

The Provident Fund

Professional Tax

Employee State Insurance (ESI)

It also includes benefits like health insurance, retirement plans, and paid leaves.

Employer Contributions

Employers must contribute to statutory schemes like PF and ESI. Understanding what is payroll accounting helps ensure these are properly calculated and recorded.

Payroll Accounting Process Explained

Recording Payroll Transactions

All payroll-related transactions are recorded in journal entries. The deductions, net pay, and gross wages are all meticulously accounted for. Audits are made easier and financial transparency is promoted as a result.

Tax Calculations and Deductions

Payroll systems calculate applicable taxes and automatically deduct them from employee salaries. These deductions are then submitted to the government, avoiding penalties and non-compliance.

Payslip Generation and Reporting

Employees receive payslips that detail their earnings, deductions, and take-home salary. Transparency and future reference depend on these reports.

Payroll Accounting vs. General Accounting

Differences in Process and Purpose

Payroll accounting specifically deals with employee compensation, while general accounting records all company financials. It requires additional attention due to tax regulations and employee entitlements.

Why Payroll Requires Specialized Knowledge

Knowing “what is payroll accounting” means knowing that it is a very specific field. To effectively manage it, accountants need to be familiar with payroll software systems, tax codes, and labor laws.

Common Payroll Accounting Software

Top Software Used in India

Some popular software tools used in India for payroll accounting include:

GreytHR

Keka

Zoho Payroll

ADP India

Saral PayPack

These tools make make the understanding of “what is payroll accounting ” easier and streamline the payroll process, reduce errors, and ensure timely disbursements.

Features to Look for in Payroll Tools

When choosing a payroll tool, make sure it offers:

Tax compliance automation

Creation of pay stubs

Multi-location support

Employee self-service portal

Integration with attendance systems

These features make it easier for businesses to manage employee compensation efficiently.

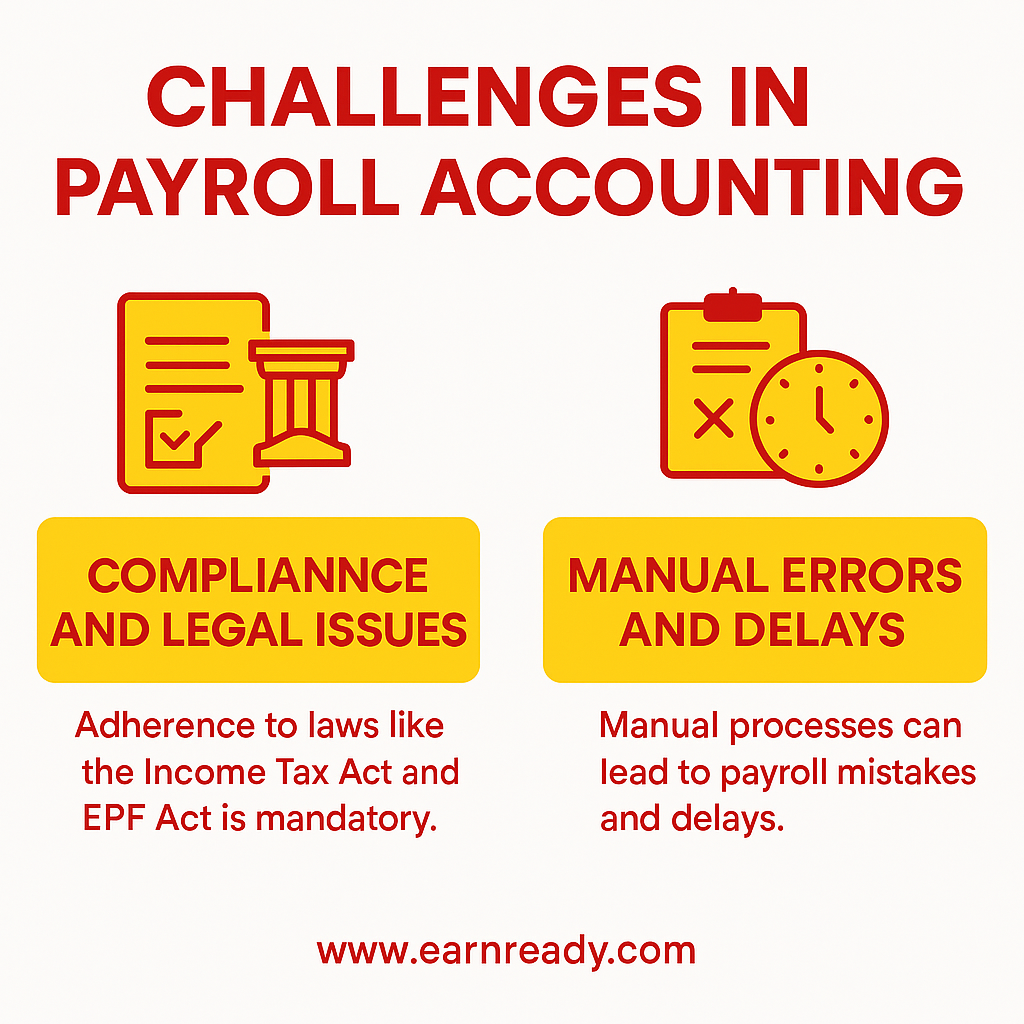

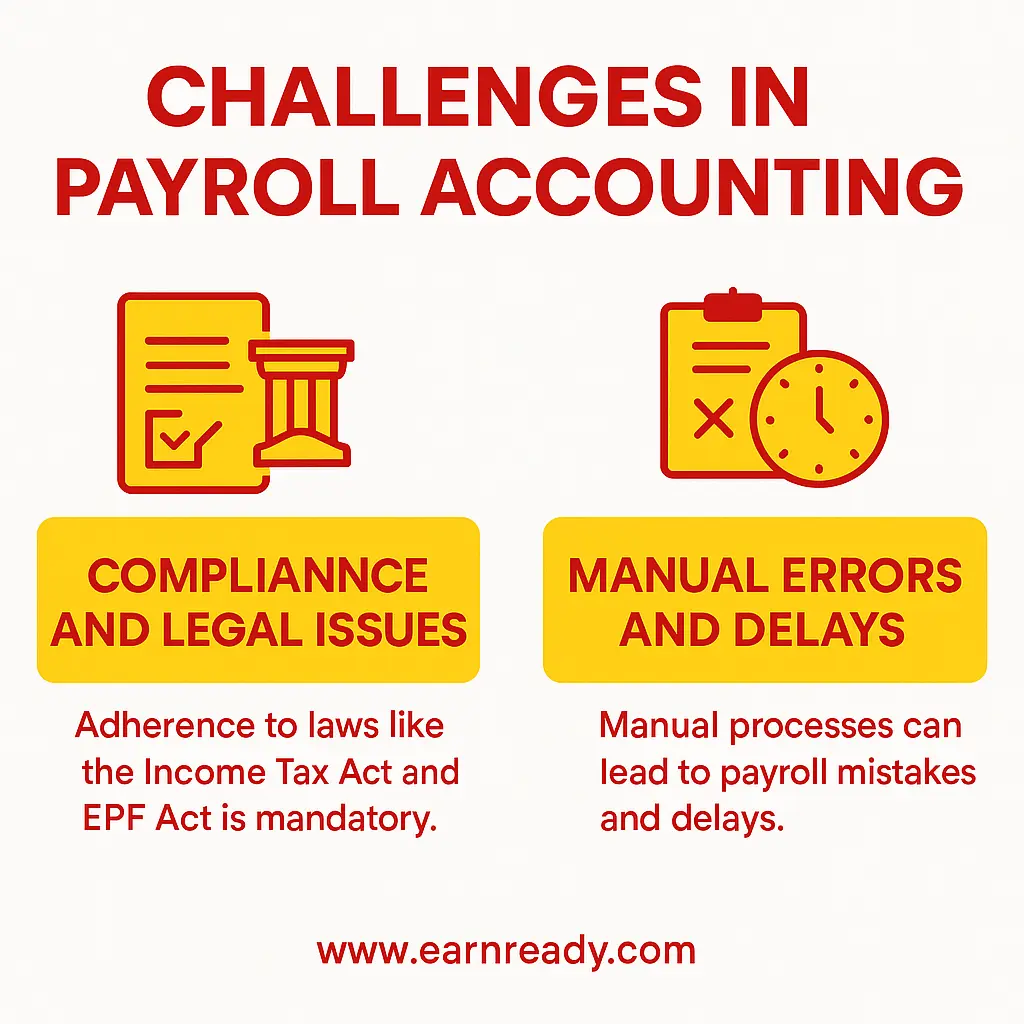

Challenges in Payroll Accounting

Compliance and Legal Issues

Payroll accounting must comply with multiple laws, including the Payment of Wages Act, Income Tax Act, and EPF Act. Failing to comply may result in audits, fines, or legal proceedings.

Manual Errors and Delays

Manual payroll processing can lead to human errors, delayed payments, and miscalculations. Using payroll software helps solve these problems and makes operations run more smoothly.

Career Opportunities in Payroll Accounting

In-Demand Job Roles

Understanding what is payroll accounting opens up many lucrative career paths:

Payroll Accountant

HR Payroll Executive

Specialist in Payroll

Manager of Compensation and Benefits

Finance Officer with Payroll Specialization

These roles are essential in every organization and often come with long-term growth potential.

Skills Required for Payroll Accounting Professionals

To thrive in payroll accounting, professionals should have:

Knowledge of tax laws and labor regulations

Knowledge of payroll software

Analytical thinking

Attention to detail

Communication skills

Certified professionals in payroll accounting often receive better salary packages and faster career progression.

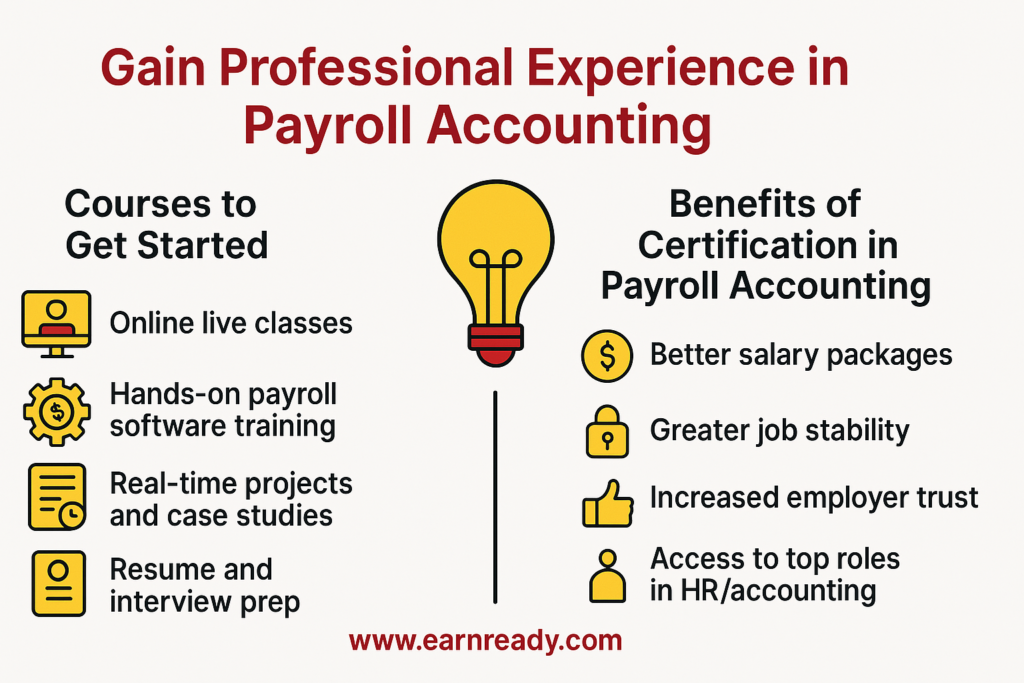

Gain professional experience in payroll accounting

Courses to Get Started

If you’re serious about building a career in HR or finance, don’t just ask what is payroll accounting — learn how to master it.

EarnReady offers one of India’s best courses in HR and Payroll Accounting, including:

Online live classes

Hands-on payroll software training (Zoho Payroll, Excel, etc.)

Real-time projects and case studies

Resume building and interview preparation

100% job assistance

Benefits of Certification in Payroll Accounting

Certified payroll professionals gain:

Better salary packages

Greater job stability

Increased trustworthiness among employers

Access to top HR and accounting roles

If you’re a student, job-seeker, or working professional, this is your gateway to a high-paying, stable, and respected career.

What qualifications are needed?

How much can a payroll accountant earn?

Is payroll accounting needed in small businesses?

Ultimate Guide: What is HR Payroll and Why It’s a Game-Changer for Businesses

Ultimate Guide: What is HR Payroll and Why It’s a Game-Changer for Businesses

Introduction

In today’s competitive job market, businesses are constantly looking for effective ways to manage their workforce. Payroll is one of the most critical yet often misunderstood parts of business operations. If you’re wondering what is HR payroll, you’re not alone. Understanding HR payroll is essential for smooth employee management, legal compliance, and building employee satisfaction—whether you’re an HR professional, business owner, or student.

What is HR Payroll?

What is HR payroll? In simple terms, it is the process through which an organization handles employee compensation. This includes calculating salaries, withholding applicable taxes and deductions, managing bonuses, and ensuring timely salary disbursement.

In addition to salary processing, HR payroll also involves regulatory filings, maintaining records, and managing employee benefits. It connects the HR and finance departments and plays a key role in managing staff and meeting legal obligations.

Payroll isn’t just about processing payments—it requires thorough knowledge of tax structures, financial laws, and HR policies. When done right, HR payroll boosts efficiency, transparency, and employee trust.

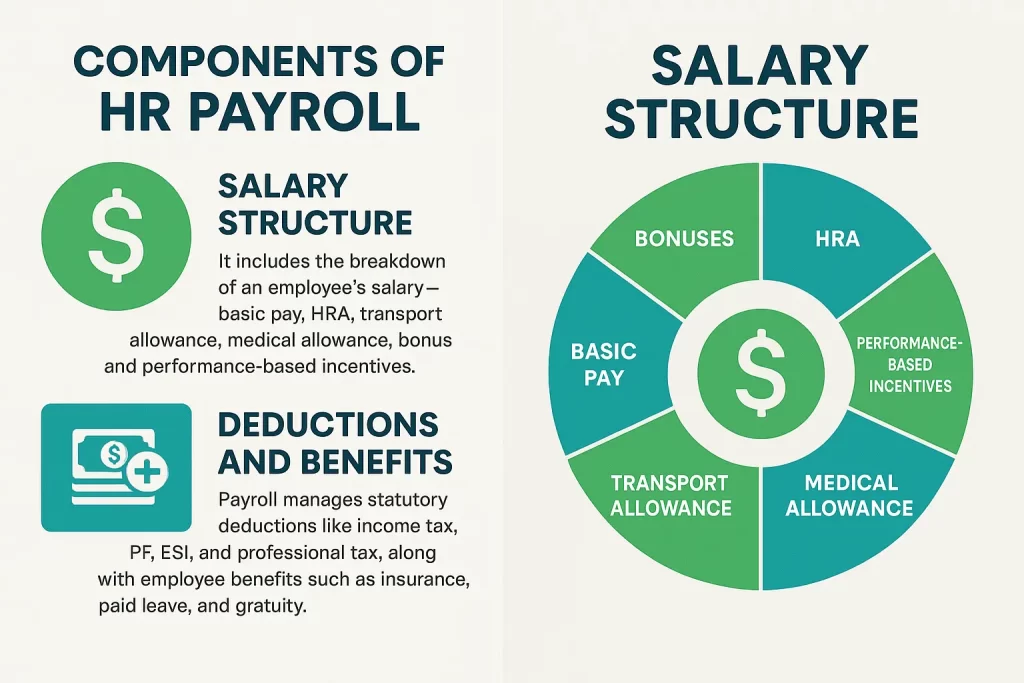

Components of HR Payroll

To understand what is HR payroll, it’s important to break it down into its core components. Payroll involves more than cutting cheques at the end of the month.

Salary Structure

The salary structure is the foundation of any payroll system. It consists of basic pay, House Rent Allowance (HRA), transport allowance, medical benefits, bonuses, and other incentives. A transparent salary structure ensures clarity and reduces confusion or conflict among employees.

Deductions and Benefits

Payroll also includes mandatory and voluntary deductions like:

Income Tax

Provident Fund (PF)

Employee State Insurance (ESI)

Professional Tax

Simultaneously, HR payroll involves managing benefits like health insurance, gratuity, paid time off, and retirement contributions. Accurate handling of these elements is essential for compliance and employee morale.

How HR Payroll Works in a Company

Understanding what is HR payroll means knowing the actual steps it involves within a company:

Data Collection – Gathering attendance, leave, and performance records.

Salary Calculation – Calculating gross and net salaries after deductions and taxes.

Disbursement – Transferring salaries to employee accounts on time.

Compliance Filing – Submitting TDS, PF, and ESI to government agencies.

Payslip Generation – Issuing payslips showing detailed salary breakdown.

Payroll typically runs monthly, but preparations begin weeks ahead. It requires strong coordination between HR, accounts, and IT teams.

Importance of HR Payroll in Business

If you’re still asking yourself what is HR payroll good for, the answer lies in its importance:

Legal Compliance – Helps fulfill tax obligations and labor laws.

Employee Trust – On-time, accurate salary boosts trust and engagement.

Operational Efficiency – Reduces errors and saves time through automation.

Reputation Management – Prevents penalties and ensures a good employer brand.

Financial Planning – Payroll data supports budgeting and cost control.

An efficient HR payroll system is a backbone of any growing business.

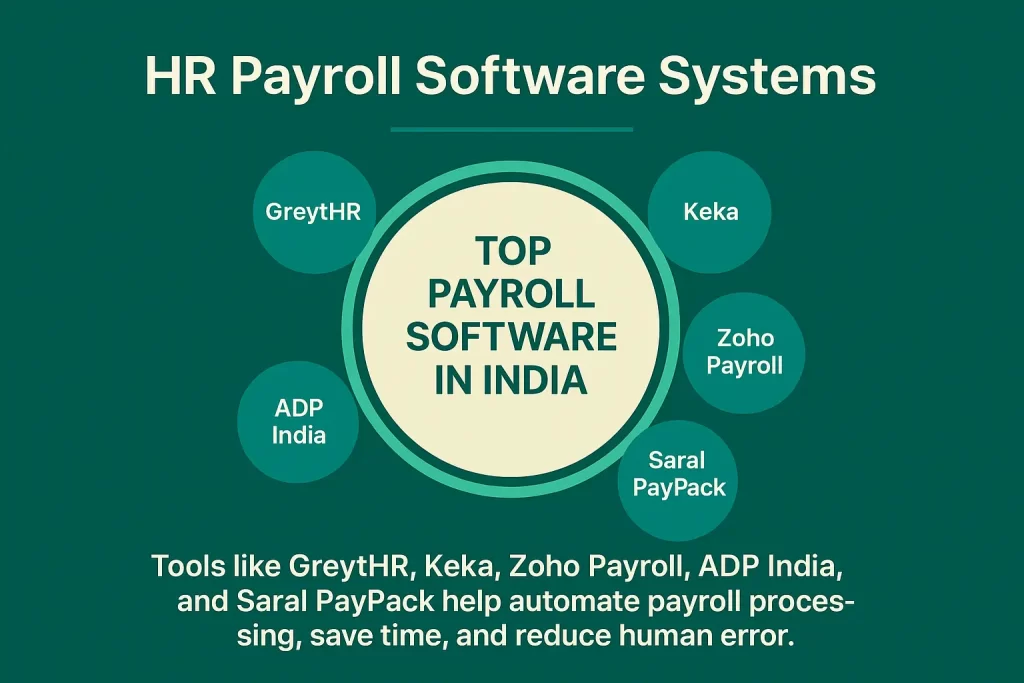

HR Payroll Software Systems

With digital transformation on the rise, manual payroll processes are being replaced with smart payroll software. Knowing what is HR payroll also means understanding the tools that make it work smoothly.

Top Payroll Software in India

GreytHR

Keka

Zoho Payroll

ADP India

Saral PayPack

These platforms help automate salary calculations, generate payslips, ensure tax compliance, and reduce errors.

You can explore more about payroll systems from this

Career Opportunities in HR Payroll

Once you understand what is HR payroll, you’ll realize how it unlocks lucrative career paths.

Popular Job Roles

Payroll Executive

HR Executive – Payroll

Payroll Analyst

Compensation & Benefits Manager

HRIS (Human Resources Information System) Specialist

Essential Skills

Strong knowledge of Indian labor laws and tax structures

Expertise in payroll software

Data analysis and reporting

High attention to detail

Strong communication and confidentiality

Certified payroll professionals are in high demand, especially in industries like IT, finance, and manufacturing.

Learn HR Payroll with EarnReady

It’s not enough to just ask what is HR payroll—you need practical knowledge. That’s where EarnReady comes in. EarnReady offers India’s most practical HR course with payroll training tailored for job-readiness.

Course Highlights

Live classes with industry professionals

Hands-on training in Excel, Zoho Payroll, and Keka

Real case studies and assignments

Resume-building and interview prep

Guaranteed job placement support

Whether you’re a fresher or switching careers, EarnReady equips you with the skills employers want. Their training covers everything from basics to advanced payroll processing.

What is HR payroll and how is it different from general payroll?

2. Is HR payroll essential for small businesses?

3. Which payroll software is best for Indian companies?

Best Accounting Software in India – Trusted Tools for Accountants

" Best Accounting Software in India – Trusted Tools for Accountants"

Image of post regarding course

Table of Contents

- Introduction

- Why Accountants Need to Know About Accounting Software

- Key Features to Look for in Accounting Software

- Top 7 Best Accounting Software in India for Accountants to Learn in 2025

- The Best Certification Programs in India to Learn Accounting Software

- Skills on Demand in Addition to Accounting Software

- Most Commonly Asked Questions

Introduction Every accountant who wants to advance their career, simplify their finances, and remain in compliance with the most recent GST regulations needs to have access to the best accounting software available in India. Learning the right software can lead to high-paying jobs for students, business owners, and finance professionals alike.

olffer image

Why Accountants Need to Know About Accounting Software

With the increasing digitization of finance and taxation in India, accountants must be tech-savvy. Professionals with the ability to effectively manage ledgers, file GST returns, and analyze financial data are now in high demand from businesses. From startups to MNCs, every business relies on accounting software to keep their books clean. The right tool can significantly reduce human error and save hours of manual labor.

olffer image

Key Features to Look for in the Best Accounting Software in India

GST Completion The Goods and Services Tax is the central component of India’s tax system. For easy filing and billing, make sure the software you learn has built-in GST compliance.

User-Friendly InterfaceEven for novices, using an intuitive interface makes learning simple.

Using the Cloud Modern software solutions offer cloud access, which is ideal for remote teams and data security.

Electronic Reporting Time is saved and the likelihood of making mistakes in financial reports is reduced by automation and the demand for tally is increasing.

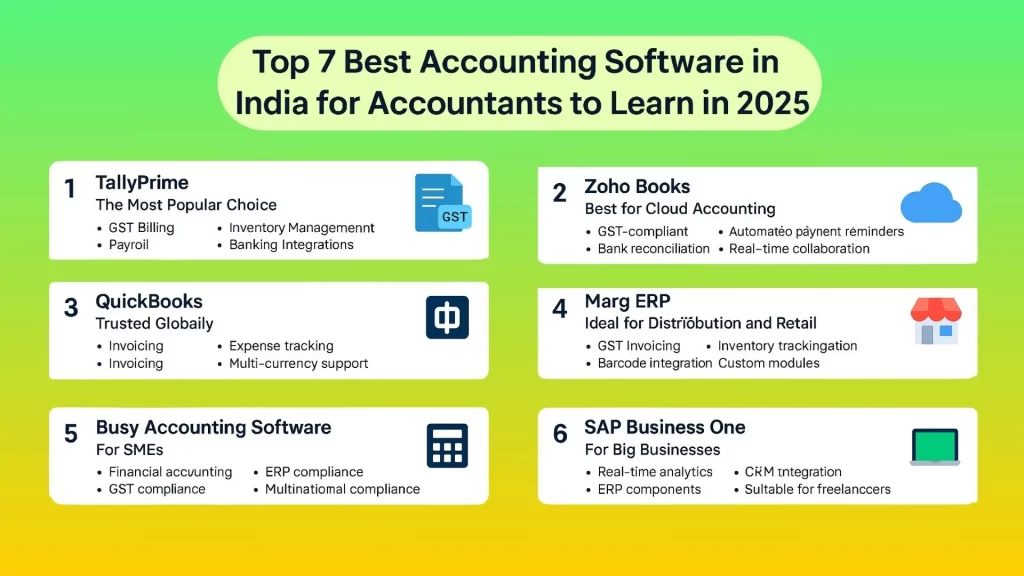

Top 7 Best Accounting Software in India for Accountants to Learn in 2025

1. TallyPrime – The Most Popular Choice For a number of years, Tally has dominated the Indian market. TallyPrime is the updated version and offers a user-friendly interface with comprehensive features.

Key Features:

GST Billing

Inventory Management

Payroll

Banking Integrations

2. Zoho Books – Best for Cloud Accounting Zoho Books is ideal for freelancers, new businesses, and established ones. It is cloud-based and reasonably priced.

Key Features:

GST-compliant

Automated payment reminders

Bank reconciliation

Real-time collaboration

3. QuickBooks – Trusted Globally QuickBooks by Intuit is well-known all over the world and has a lot of features for Indian users.

Key Features:

Invoicing

Expense tracking

Multi-currency support

Mobile accessibility

4. Marg ERP – Ideal for Distribution and Retail Marg ERP is widely used by retailers and pharmaceutical companies in India.

Key Features:

GST Invoicing

Barcode Integration

Inventory tracking

Custom modules

5. Busy Accounting Software – For SMEs Another piece of software developed locally that caters to small and medium-sized businesses is called Busy.

Key Features:

Financial accounting

GST compliance

MIS reports

Multi-location inventory

6. SAP Business One – For Big Businesses Large businesses that require in-depth analytics and reports can benefit from SAP Business One.

Key Features:

Real-time analytics

ERP components

CRM Integration

Multinational compliance

7. Wave Accounting – Free and Beginner-Friendly If you’re starting your accounting journey, Wave is a great entry point.

Key Features:

Free forever

Easy interface

Receipts & invoices

Suitable for freelancers

need more information related to accounting check this here

Should You Choose an Accounting Software?

Choosing the right accounting software depends on your career goals, business type, and the complexity of accounting tasks you handle. Whether you’re a student aiming for certification, a freelancer managing invoices, or a professional accountant in an MNC, there’s a tool tailored for your needs.

Here’s a quick comparison to help you choose:

| Software | Best For | Key Feature Highlight |

|---|---|---|

| TallyPrime | Beginners & GST Professionals | Offline GST Billing & Inventory |

| Zoho Books | Startups & Cloud Accounting | Cloud Access & Real-Time Sharing |

| QuickBooks | Freelancers & Small Businesses | Global Currency & Mobile Support |

| Marg ERP | Retailers & Pharma Distributors | Barcode Integration |

| Busy Software | SMEs | Multi-location Inventory |

| SAP Business One | Corporates & Enterprises | ERP + CRM + Analytics |

| Wave | Freelancers & Beginners | 100% Free & Easy to Use |

The Best Certification Programs in India to Learn Accounting Software

Course on GST Tally This course, which is offered by a lot of schools all over India, covers tax compliance, inventory management, and billing.

Partner Certification for Zoho Books Zoho offers a certified program for accountants and partners.

QuickBooks ProAdvisor Certification This internationally recognized certification is ideal for independent accountants

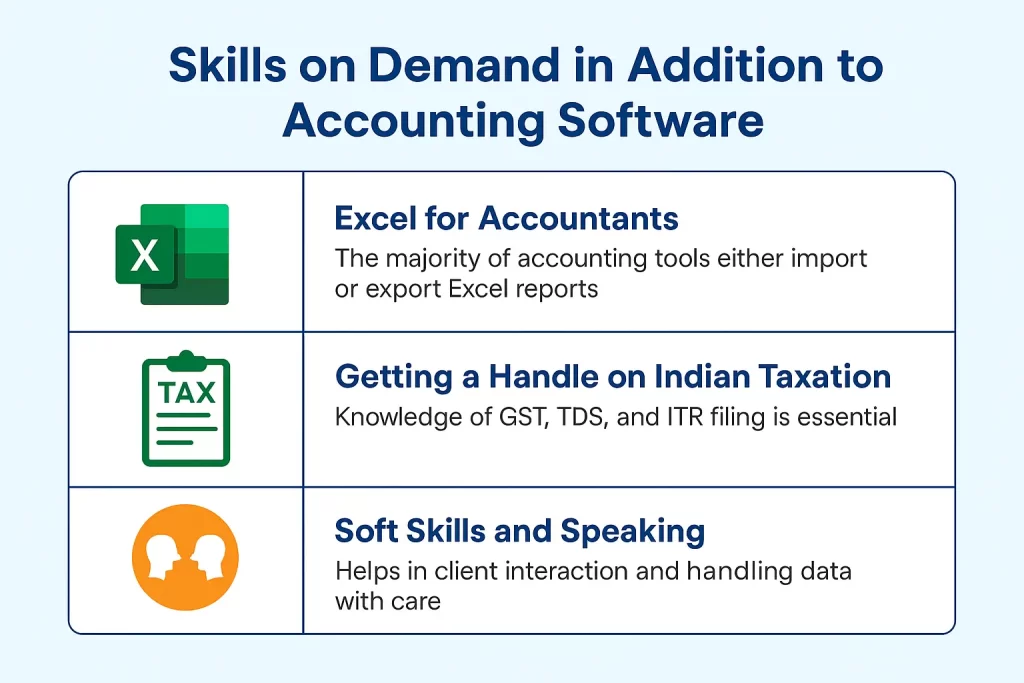

Skills on Demand in Addition to Accounting Software

If you’re serious about mastering the best accounting software in India, combine it with these skills:

Excel for Accountants The majority of accounting tools either import or export Excel reports.

Getting a Handle on Indian Taxation Knowledge of GST, TDS, and ITR filing is essential.

Soft Skills and Speaking Helps in client interaction and handling data with care.