HR Course Online 2025: Ultimate Power Guide to Skyrocket Your Career in Human Resource

HR Course Online 2025: Ultimate Power Guide to Skyrocket Your Career in Human Resource

Table of Contents

- Introduction

- What is HR Course Online?

- Importance of HR Online Training

- Top Benefits of HR Course Online

- Who Should Enroll in HR Online Courses?

- How to Start HR Career After 12th?

- Essential Skills You Learn in HR Course Online

- HR Career Path Without Experience

- Why Choose EarnReady HR Courses?

- Salary and Career Growth in HR

- Frequently Asked Questions

Introduction

HR course online programs are transforming how we enter the human resource industry. Whether you’re a student who just passed 12th or someone looking to start fresh, HR online training gives you a professional edge. In this guide, we’ll break down everything you need to know about choosing and succeeding in an HR course online.

What is HR Course Online?

HR course online refers to a virtual training program designed to teach human resource management, payroll, recruitment, employee engagement, and related skills. These courses help students gain industry-level knowledge without physically attending college.

Importance of HR Online Training

HR online training allows students to learn from anywhere, anytime. It saves time, reduces costs, and offers certification that is accepted by many companies globally. You also get hands-on practice with case studies and HR software.

Top Benefits of HR Course Online

Study from home with flexibility

Learn practical skills like payroll, HRMS, and recruitment

Access career-focused modules designed by industry experts

Get certification to apply for entry-level HR jobs

Start working right after 12th without a degree

Who Should Enroll in HR Online Courses?

Anyone interested in management, people skills, or administrative roles should take an HR course online. This includes:

12th pass students

College dropouts

Housewives returning to the workforce

Freshers looking for job-oriented short courses

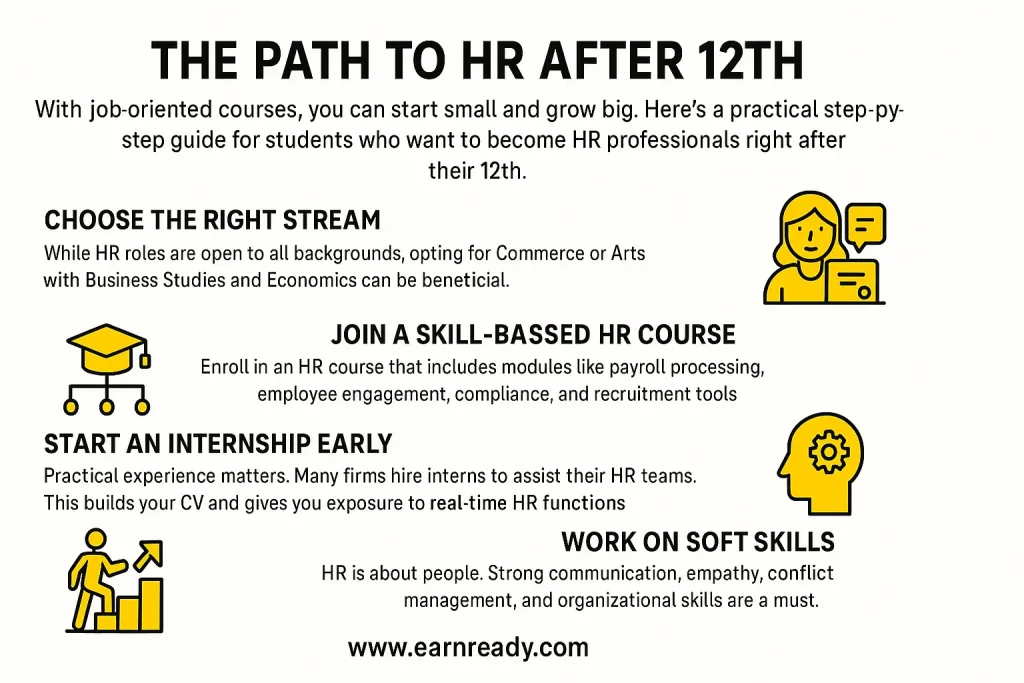

How to Start HR Career After 12th?

To start your HR career after 12th, you can directly enroll in job-oriented HR online training. These short-term programs from platforms like EarnReady provide real-life HR assignments, internship opportunities, and resume-building support.

Essential Skills You Learn in HR Course Online

Here are key HR skills taught in most HR course online programs:

Payroll management

Attendance tracking systems

Recruitment and selection process

Handling employee grievances

HR documentation and legal compliance

Software like Tally, Excel, HRMS tools

HR Career Path Without Experience

Yes, you can build an HR career even if you don’t have any prior experience. By completing a practical HR course online, companies are willing to hire you for roles such as:

HR Intern

Payroll Coordinator

HR Executive Trainee

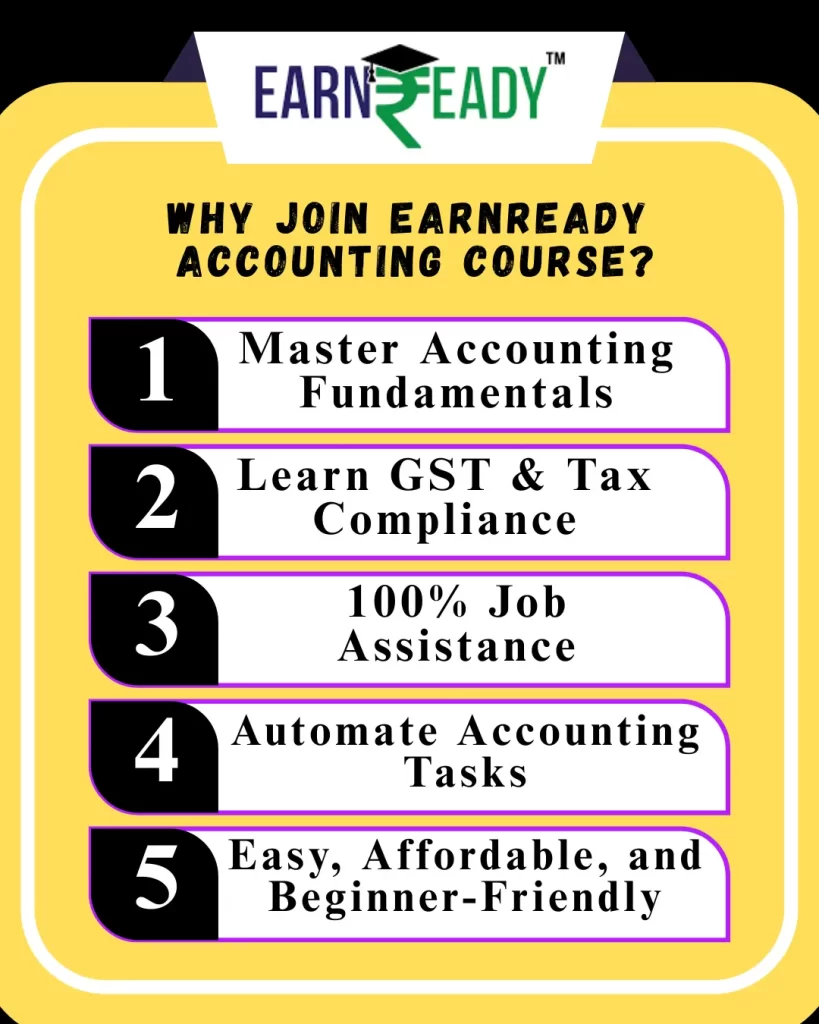

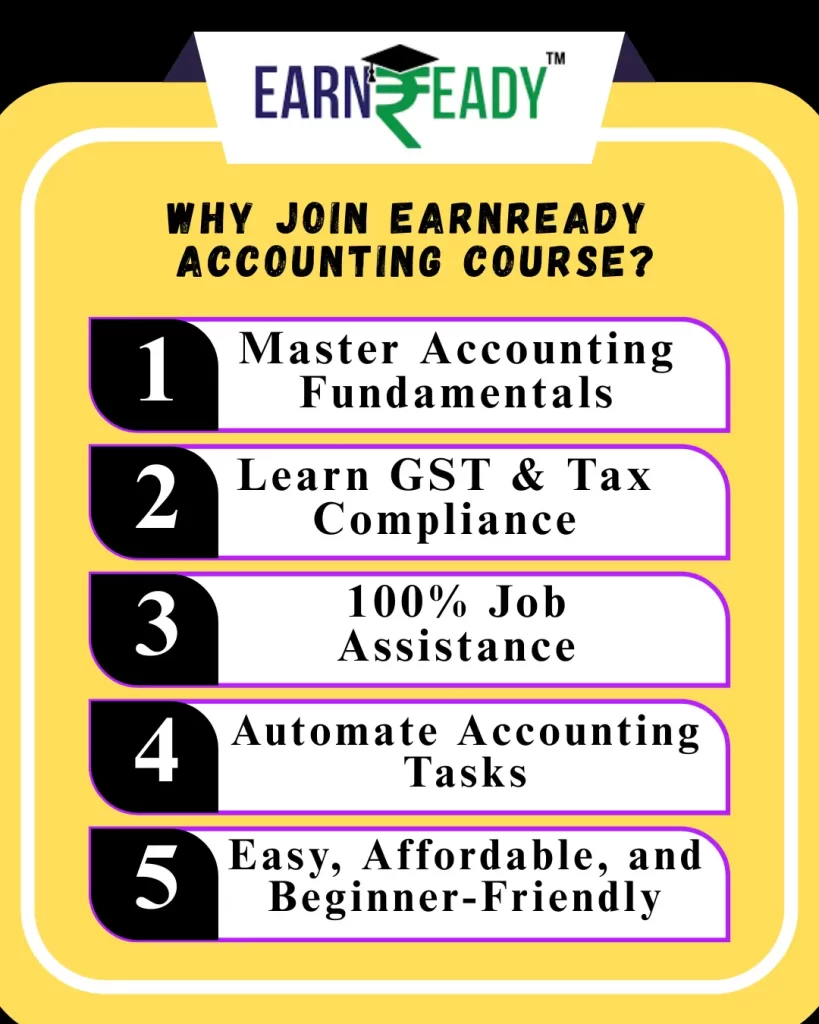

Why Choose EarnReady HR Courses?

EarnReady offers specialized HR online training created for absolute beginners. Here’s why students prefer our platform:

Courses start immediately after 12th

Practical assignments based on real-world HR cases

Internship certificate included

Resume-building sessions

Personalized mentorship and job placement support

Unlike traditional colleges, EarnReady courses are quick, affordable, and more aligned with industry needs.

Salary and Career Growth in HR

Starting salaries after completing HR course online can range between ₹10,000 to ₹20,000 monthly for freshers. With 2–3 years of experience, your role may advance to HR Manager, and your salary could rise to ₹35,000–₹50,000 per month.

Roles you can grow into:

Recruitment Specialist

Payroll Analyst

HR Business Partner

Training and Development Officer